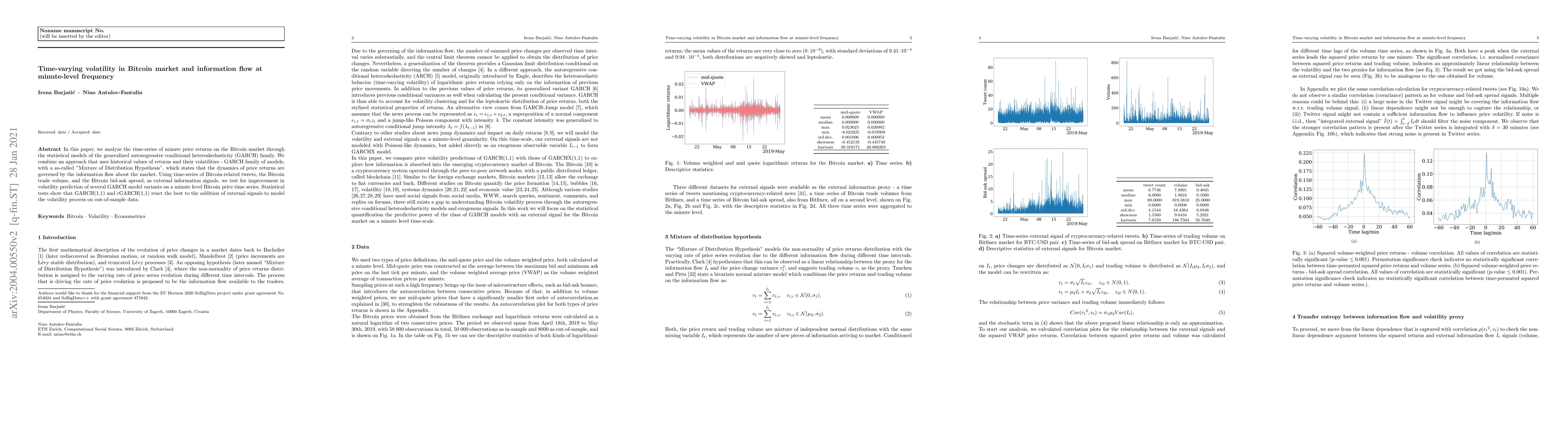

Summary

In this paper, we analyze the time-series of minute price returns on the Bitcoin market through the statistical models of generalized autoregressive conditional heteroskedasticity (GARCH) family. Several mathematical models have been proposed in finance, to model the dynamics of price returns, each of them introducing a different perspective on the problem, but none without shortcomings. We combine an approach that uses historical values of returns and their volatilities - GARCH family of models, with a so-called "Mixture of Distribution Hypothesis", which states that the dynamics of price returns are governed by the information flow about the market. Using time-series of Bitcoin-related tweets and volume of transactions as external information, we test for improvement in volatility prediction of several GARCH model variants on a minute level Bitcoin price time series. Statistical tests show that the simplest GARCH(1,1) reacts the best to the addition of external signal to model volatility process on out-of-sample data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)