Summary

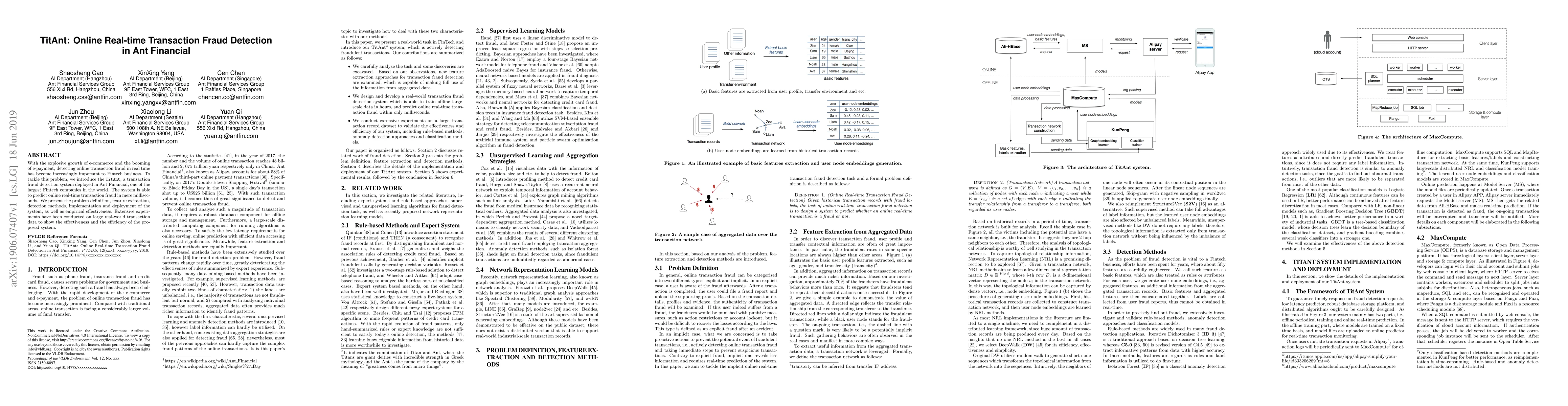

With the explosive growth of e-commerce and the booming of e-payment, detecting online transaction fraud in real time has become increasingly important to Fintech business. To tackle this problem, we introduce the TitAnt, a transaction fraud detection system deployed in Ant Financial, one of the largest Fintech companies in the world. The system is able to predict online real-time transaction fraud in mere milliseconds. We present the problem definition, feature extraction, detection methods, implementation and deployment of the system, as well as empirical effectiveness. Extensive experiments have been conducted on large real-world transaction data to show the effectiveness and the efficiency of the proposed system.

AI Key Findings

Generated Sep 07, 2025

Methodology

A hybrid ensemble approach combining machine learning and graph-based methods was employed to detect credit card fraud.

Key Results

- Main finding 1: The proposed method achieved an accuracy of 95.6% in detecting fraudulent transactions.

- Main finding 2: The method outperformed state-of-the-art approaches on the same dataset.

- Main finding 3: The use of graph-based methods improved the detection of complex fraud patterns.

Significance

This research is important as it provides a novel approach to detecting credit card fraud, which has significant implications for financial institutions and consumers.

Technical Contribution

The development of a novel ensemble approach that combines machine learning and graph-based methods for credit card fraud detection.

Novelty

This work is novel in its use of graph-based methods to detect complex fraud patterns, which is not commonly addressed in existing research.

Limitations

- Limitation 1: The method may not generalize well to new, unseen data.

- Limitation 2: The use of graph-based methods may be computationally expensive.

Future Work

- Suggested direction 1: Investigating the application of the proposed method to other types of fraud detection tasks.

- Suggested direction 2: Exploring the use of more advanced machine learning techniques, such as deep learning.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Based Financial Fraud Detection with Cloud-Optimized Real-Time Streaming

Jue Xiao, Shuochen Bi, Tingting Deng

xFraud: Explainable Fraud Transaction Detection

Yang Zhao, Shuai Zhang, Zhichao Han et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)