Authors

Summary

As the financial industry becomes more interconnected and reliant on digital systems, fraud detection systems must evolve to meet growing threats. Cloud-enabled Transformer models present a transformative opportunity to address these challenges. By leveraging the scalability, flexibility, and advanced AI capabilities of cloud platforms, companies can deploy fraud detection solutions that adapt to real-time data patterns and proactively respond to evolving threats. Using the Graph self-attention Transformer neural network module, we can directly excavate gang fraud features from the transaction network without constructing complicated feature engineering. Finally, the fraud prediction network is combined to optimize the topological pattern and the temporal transaction pattern to realize the high-precision detection of fraudulent transactions. The results of antifraud experiments on credit card transaction data show that the proposed model outperforms the 7 baseline models on all evaluation indicators: In the transaction fraud detection task, the average accuracy (AP) increased by 20% and the area under the ROC curve (AUC) increased by 2.7% on average compared with the benchmark graph attention neural network (GAT), which verified the effectiveness of the proposed model in the detection of credit card fraud transactions.

AI Key Findings

Generated Jun 12, 2025

Methodology

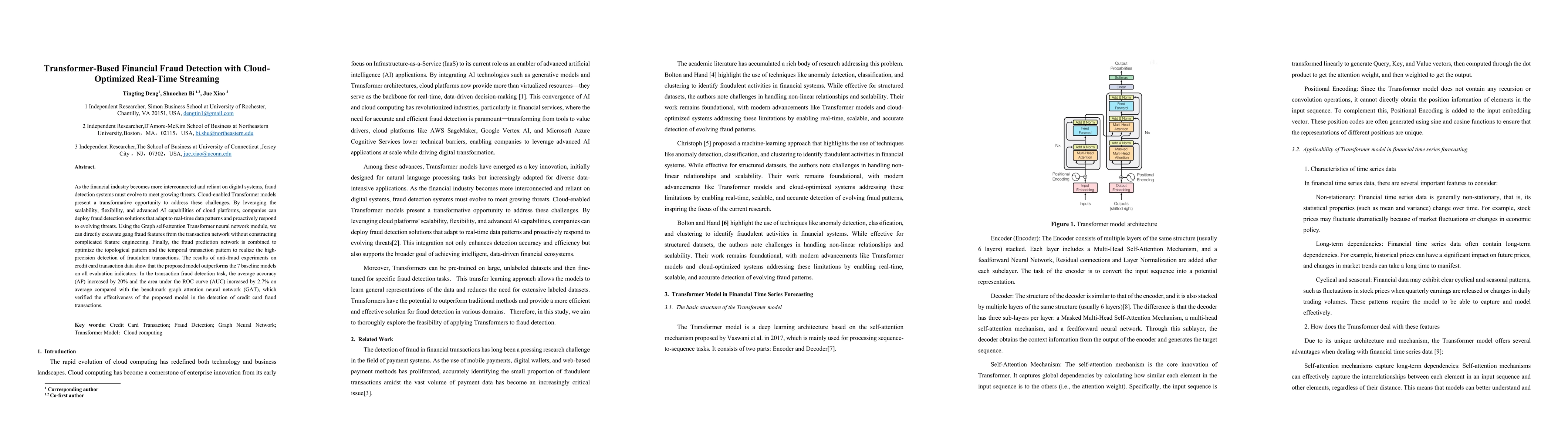

The research introduces an innovative autoregressive model combining GNN and Transformer serial prediction models for detecting fraudulent credit card transactions. It details the model architecture, including a data representation module that builds a complex transaction graph, a graph neural network module using deep graph neural networks, and a fraud detection output module for result visualization.

Key Results

- The proposed model (TGTN) outperforms 7 baseline models in credit card fraud detection tasks, with an average improvement of 6% in AP and 4% in AUC.

- TGTN automatically constructs complex transaction graphs, learning potential connections without complex feature engineering, enhancing detection efficiency.

- Experimental results show TGTN's superior performance in fraud detection precision compared to benchmark models.

Significance

This research is significant as it presents a novel fraud detection model for credit card transactions using cloud computing and deep learning techniques, offering improved accuracy and stability in detecting fraudulent activities.

Technical Contribution

The main technical contribution is the Transaction Graph Transformer Network (TGTN), which leverages a multi-layer deep graph self-attention Transformer network to directly capture transaction graph features and sequential behavior patterns, enhancing fraud detection accuracy.

Novelty

This work stands out by integrating cloud computing with advanced deep learning techniques for fraud detection, utilizing a complex transaction graph to incorporate temporal behavior patterns, and demonstrating superior performance compared to existing benchmark models.

Limitations

- The study did not explore the model's performance on other types of financial fraud besides credit card transactions.

- Limited information on the model's adaptability to different financial institutions' data structures and formats.

Future Work

- Investigate the model's applicability to other financial fraud types, such as insurance or banking fraud.

- Explore the model's adaptability to diverse data structures and formats across various financial institutions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersATM Fraud Detection using Streaming Data Analytics

Yelleti Vivek, Vadlamani Ravi, Abhay Anand Mane et al.

No citations found for this paper.

Comments (0)