Summary

Business Processes, i.e., a set of coordinated tasks and activities to achieve a business goal, and their continuous improvements are key to the operation of any organization. In banking, business processes are increasingly dynamic as various technologies have made dynamic processes more prevalent. For example, customer segmentation, i.e., the process of grouping related customers based on common activities and behaviors, could be a data-driven and knowledge-intensive process. In this paper, we present an intelligent data-driven pipeline composed of a set of processing elements to move customers' data from one system to another, transforming the data into the contextualized data and knowledge along the way. The goal is to present a novel intelligent customer segmentation process which automates the feature engineering, i.e., the process of using (banking) domain knowledge to extract features from raw data via data mining techniques, in the banking domain. We adopt a typical scenario for analyzing customer transaction records, to highlight how the presented approach can significantly improve the quality of risk-based customer segmentation in the absence of feature engineering.As result, our proposed method is able to achieve accuracy of 91% compared to classical approaches in terms of detecting, identifying and classifying transaction to the right classification.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

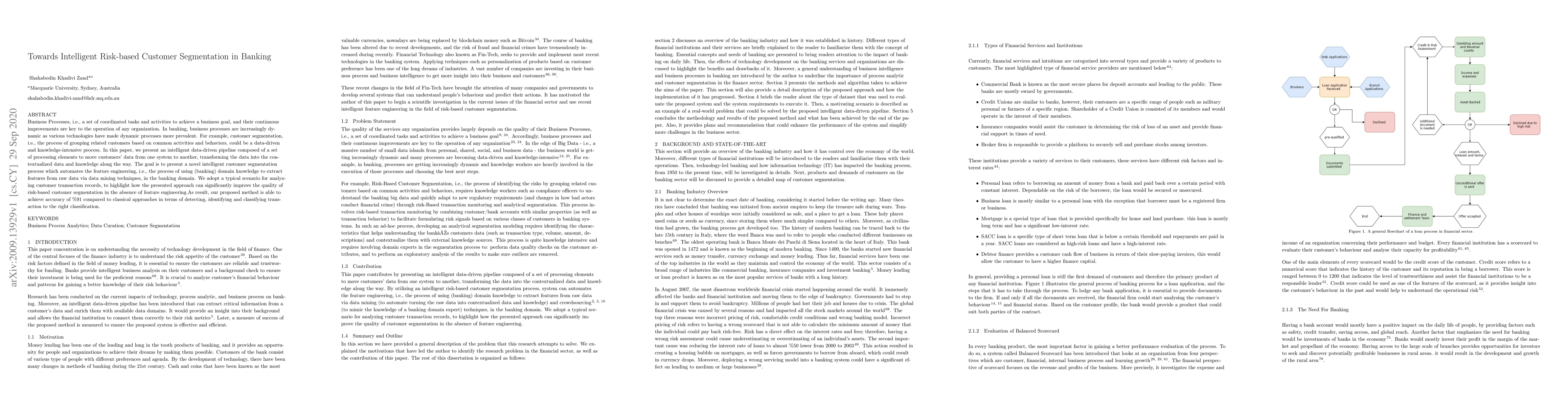

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling customer lifetime-value in the retail banking industry

Salvatore Mercuri, Raad Khraishi, Greig Cowan

| Title | Authors | Year | Actions |

|---|

Comments (0)