Summary

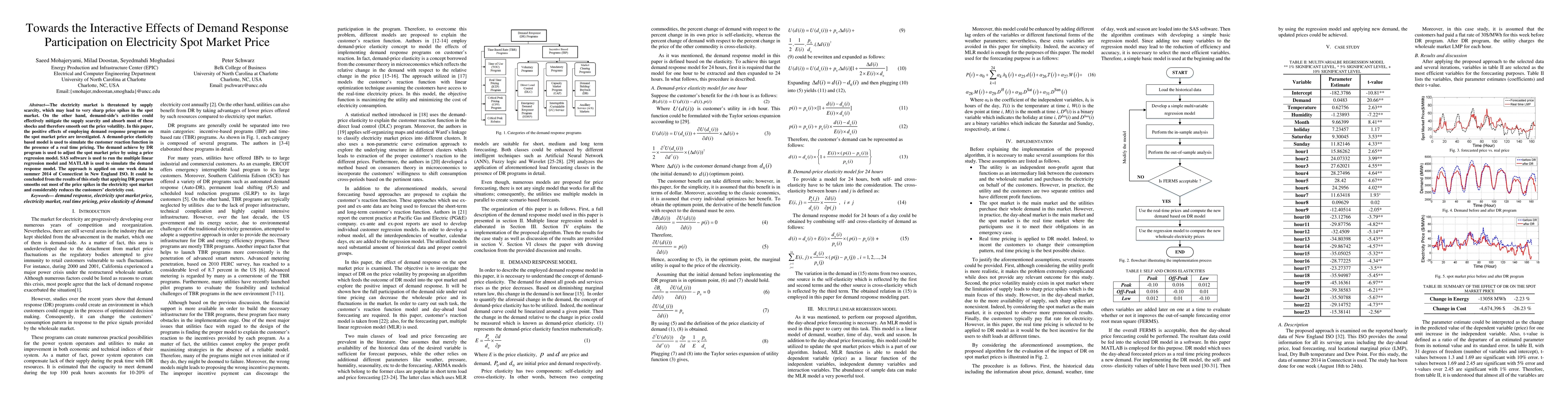

The electricity market is threatened by supply scarcity, which may lead to very sharp price spikes in the spot market. On the other hand, demand-side's activities could effectively mitigate the supply scarcity and absorb most of these shocks and therefore smooth out the price volatility. In this paper, the positive effects of employing demand response programs on the spot market price are investigated. A demand-price elasticity based model is used to simulate the customer reaction function in the presence of a real time pricing. The demand achieve by DR program is used to adjust the spot market price by using a price regression model. SAS software is used to run the multiple linear regression model and MATLAB is used to simulate the demand response model. The approach is applied on one week data in summer 2014 of Connecticut in New England ISO. It could be concluded from the results of this study that applying DR program smooths out most of the price spikes in the electricity spot market and considerably reduces the customers' electricity cost.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGrid Tariffs for Peak Demand Reduction: Is there a Price Signal Conflict with Electricity Spot Prices?

Matthias Hofmann, Sigurd Bjarghov

A Comparative Study of Factor Models for Different Periods of the Electricity Spot Price Market

Christian Laudagé, Florian Aichinger, Sascha Desmettre

| Title | Authors | Year | Actions |

|---|

Comments (0)