Authors

Summary

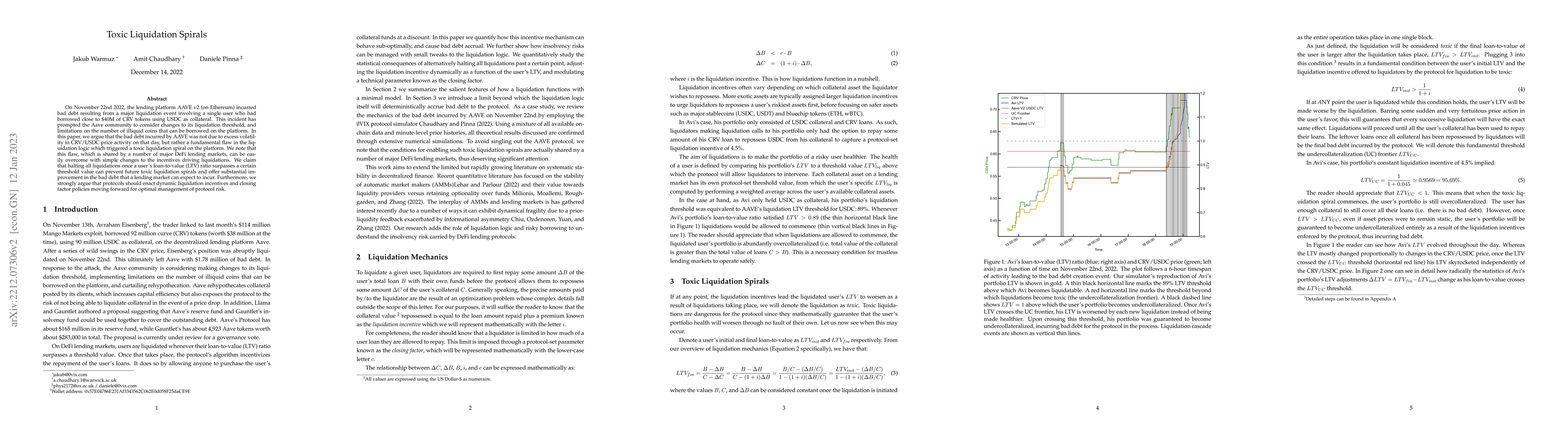

On November 22nd 2022, the lending platform AAVE v2 (on Ethereum) incurred bad debt resulting from a major liquidation event involving a single user who had borrowed close to \$40M of CRV tokens using USDC as collateral. This incident has prompted the Aave community to consider changes to its liquidation threshold, and limitations on the number of illiquid coins that can be borrowed on the platform. In this paper, we argue that the bad debt incurred by AAVE was not due to excess volatility in CRV/USDC price activity on that day, but rather a fundamental flaw in the liquidation logic which triggered a toxic liquidation spiral on the platform. We note that this flaw, which is shared by a number of major DeFi lending markets, can be easily overcome with simple changes to the incentives driving liquidations. We claim that halting all liquidations once a user's loan-to-value (LTV) ratio surpasses a certain threshold value can prevent future toxic liquidation spirals and offer substantial improvement in the bad debt that a lending market can expect to incur. Furthermore, we strongly argue that protocols should enact dynamic liquidation incentives and closing factor policies moving forward for optimal management of protocol risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)