Authors

Summary

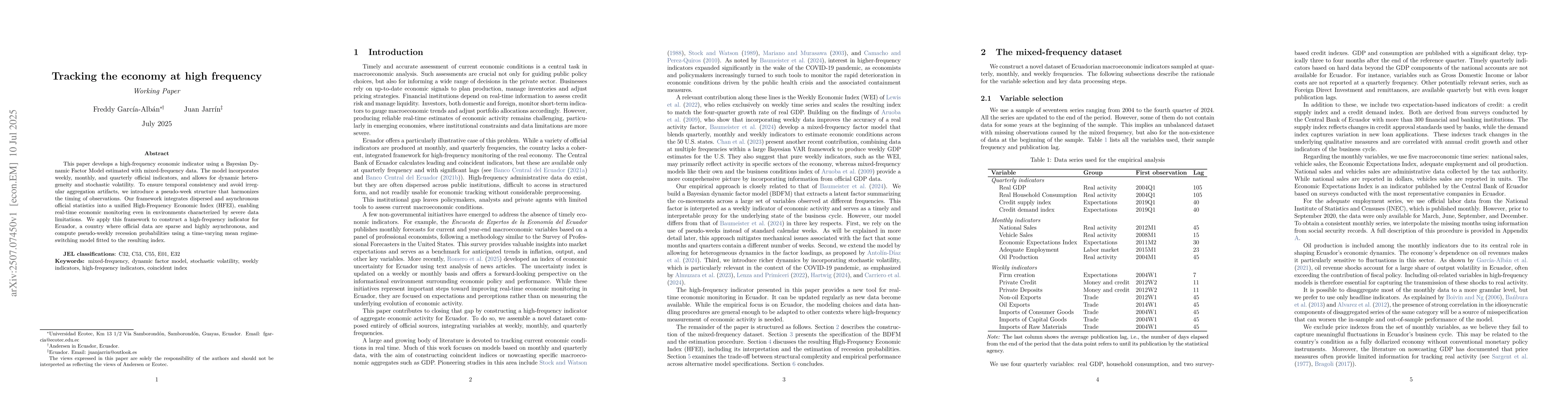

This paper develops a high-frequency economic indicator using a Bayesian Dynamic Factor Model estimated with mixed-frequency data. The model incorporates weekly, monthly, and quarterly official indicators, and allows for dynamic heterogeneity and stochastic volatility. To ensure temporal consistency and avoid irregular aggregation artifacts, we introduce a pseudo-week structure that harmonizes the timing of observations. Our framework integrates dispersed and asynchronous official statistics into a unified High-Frequency Economic Index (HFEI), enabling real-time economic monitoring even in environments characterized by severe data limitations. We apply this framework to construct a high-frequency indicator for Ecuador, a country where official data are sparse and highly asynchronous, and compute pseudo-weekly recession probabilities using a time-varying mean regime-switching model fitted to the resulting index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTracking ALMA System Temperature with Water Vapor Data at High Frequency

Hao He, William R. F. Dent, Christine Wilson

No citations found for this paper.

Comments (0)