Summary

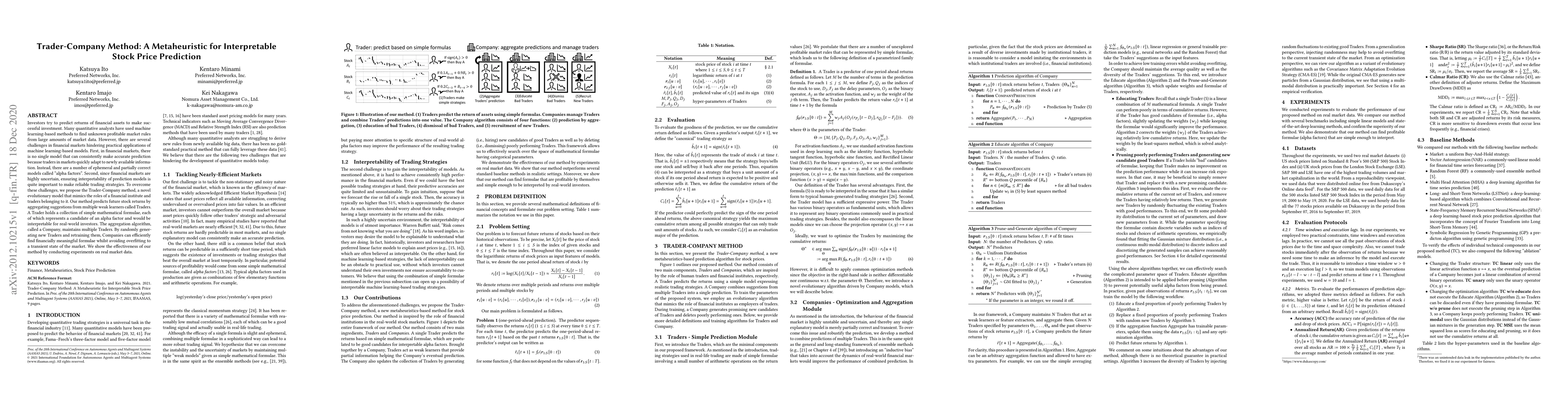

Investors try to predict returns of financial assets to make successful investment. Many quantitative analysts have used machine learning-based methods to find unknown profitable market rules from large amounts of market data. However, there are several challenges in financial markets hindering practical applications of machine learning-based models. First, in financial markets, there is no single model that can consistently make accurate prediction because traders in markets quickly adapt to newly available information. Instead, there are a number of ephemeral and partially correct models called "alpha factors". Second, since financial markets are highly uncertain, ensuring interpretability of prediction models is quite important to make reliable trading strategies. To overcome these challenges, we propose the Trader-Company method, a novel evolutionary model that mimics the roles of a financial institute and traders belonging to it. Our method predicts future stock returns by aggregating suggestions from multiple weak learners called Traders. A Trader holds a collection of simple mathematical formulae, each of which represents a candidate of an alpha factor and would be interpretable for real-world investors. The aggregation algorithm, called a Company, maintains multiple Traders. By randomly generating new Traders and retraining them, Companies can efficiently find financially meaningful formulae whilst avoiding overfitting to a transient state of the market. We show the effectiveness of our method by conducting experiments on real market data.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUncertainty Aware Trader-Company Method: Interpretable Stock Price Prediction Capturing Uncertainty

Kentaro Imajo, Kei Nakagawa, Yugo Fujimoto et al.

Meta-Stock: Task-Difficulty-Adaptive Meta-learning for Sub-new Stock Price Prediction

Qianli Ma, Zhen Liu, Linghao Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)