Summary

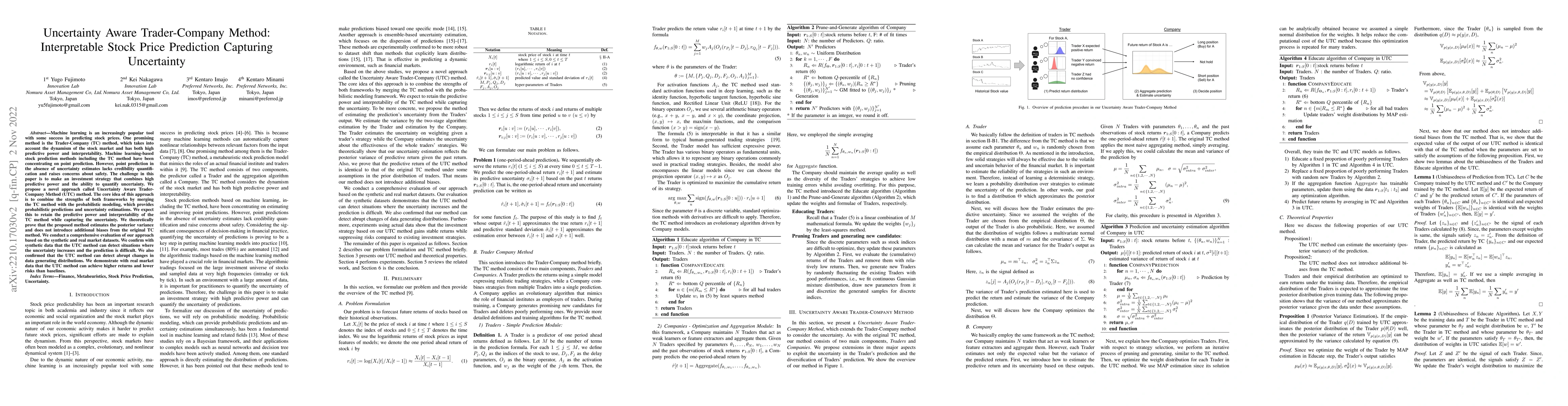

Machine learning is an increasingly popular tool with some success in predicting stock prices. One promising method is the Trader-Company~(TC) method, which takes into account the dynamism of the stock market and has both high predictive power and interpretability. Machine learning-based stock prediction methods including the TC method have been concentrating on point prediction. However, point prediction in the absence of uncertainty estimates lacks credibility quantification and raises concerns about safety. The challenge in this paper is to make an investment strategy that combines high predictive power and the ability to quantify uncertainty. We propose a novel approach called Uncertainty Aware Trader-Company Method~(UTC) method. The core idea of this approach is to combine the strengths of both frameworks by merging the TC method with the probabilistic modeling, which provides probabilistic predictions and uncertainty estimations. We expect this to retain the predictive power and interpretability of the TC method while capturing the uncertainty. We theoretically prove that the proposed method estimates the posterior variance and does not introduce additional biases from the original TC method. We conduct a comprehensive evaluation of our approach based on the synthetic and real market datasets. We confirm with synthetic data that the UTC method can detect situations where the uncertainty increases and the prediction is difficult. We also confirmed that the UTC method can detect abrupt changes in data generating distributions. We demonstrate with real market data that the UTC method can achieve higher returns and lower risks than baselines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUncertainty-Aware Mean Opinion Score Prediction

Shiwan Zhao, Jiaming Zhou, Yong Qin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)