Summary

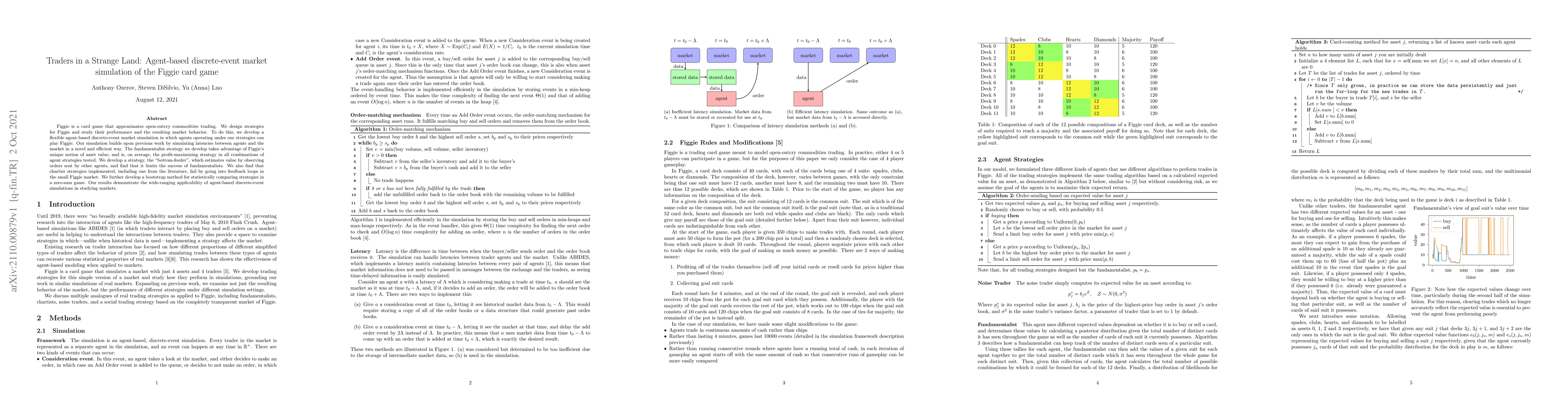

Figgie is a card game that approximates open-outcry commodities trading. We design strategies for Figgie and study their performance and the resulting market behavior. To do this, we develop a flexible agent-based discrete-event market simulation in which agents operating under our strategies can play Figgie. Our simulation builds upon previous work by simulating latencies between agents and the market in a novel and efficient way. The fundamentalist strategy we develop takes advantage of Figgie's unique notion of asset value, and is, on average, the profit-maximizing strategy in all combinations of agent strategies tested. We develop a strategy, the "bottom-feeder", which estimates value by observing orders sent by other agents, and find that it limits the success of fundamentalists. We also find that chartist strategies implemented, including one from the literature, fail by going into feedback loops in the small Figgie market. We further develop a bootstrap method for statistically comparing strategies in a zero-sum game. Our results demonstrate the wide-ranging applicability of agent-based discrete-event simulations in studying markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Multi-agent Market Model Can Explain the Impact of AI Traders in Financial Markets -- A New Microfoundations of GARCH model

Masanori Hirano, Kei Nakagawa, Kentaro Minami et al.

No citations found for this paper.

Comments (0)