Authors

Summary

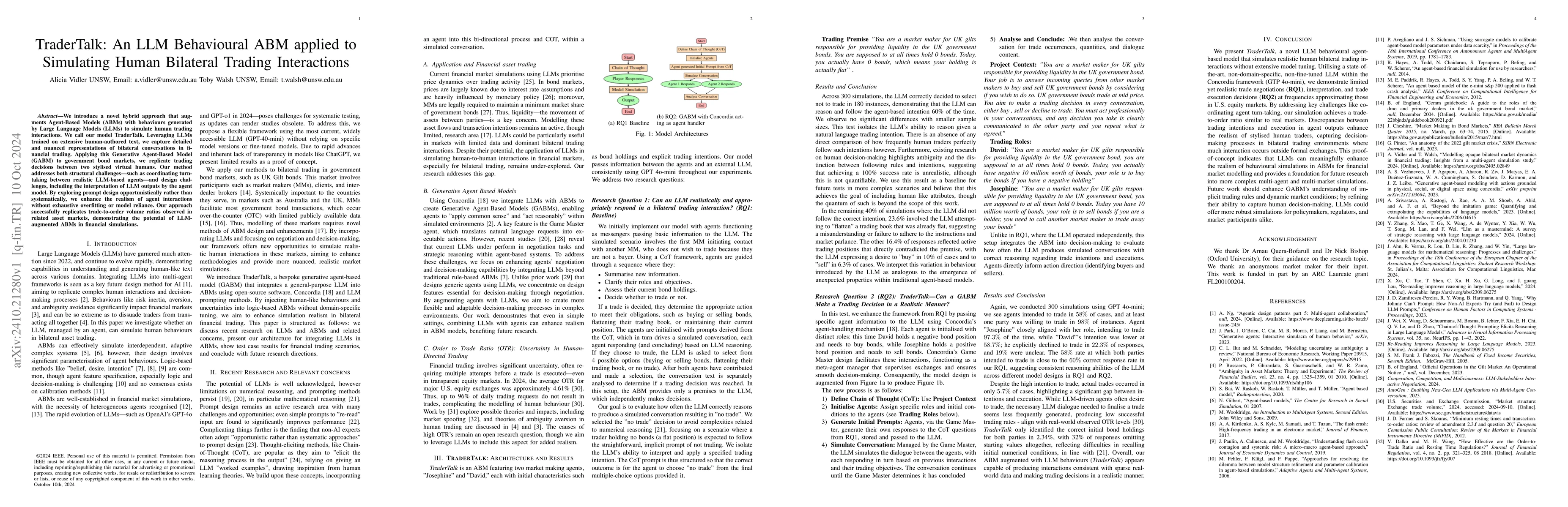

We introduce a novel hybrid approach that augments Agent-Based Models (ABMs) with behaviors generated by Large Language Models (LLMs) to simulate human trading interactions. We call our model TraderTalk. Leveraging LLMs trained on extensive human-authored text, we capture detailed and nuanced representations of bilateral conversations in financial trading. Applying this Generative Agent-Based Model (GABM) to government bond markets, we replicate trading decisions between two stylised virtual humans. Our method addresses both structural challenges, such as coordinating turn-taking between realistic LLM-based agents, and design challenges, including the interpretation of LLM outputs by the agent model. By exploring prompt design opportunistically rather than systematically, we enhance the realism of agent interactions without exhaustive overfitting or model reliance. Our approach successfully replicates trade-to-order volume ratios observed in related asset markets, demonstrating the potential of LLM-augmented ABMs in financial simulations

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLet the LLMs Talk: Simulating Human-to-Human Conversational QA via Zero-Shot LLM-to-LLM Interactions

Mohammad Aliannejadi, Evangelos Kanoulas, Zahra Abbasiantaeb et al.

LLM Roleplay: Simulating Human-Chatbot Interaction

Iryna Gurevych, Hovhannes Tamoyan, Hendrik Schuff

Decoding OTC Government Bond Market Liquidity: An ABM Model for Market Dynamics

Toby Walsh, Alicia Vidler

| Title | Authors | Year | Actions |

|---|

Comments (0)