Authors

Summary

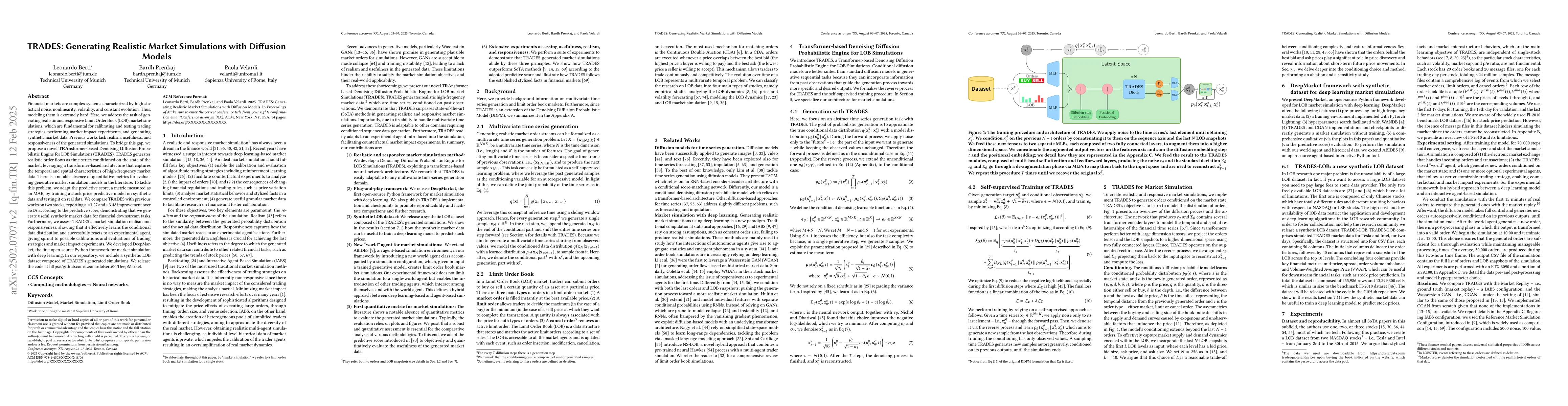

Financial markets are complex systems characterized by high statistical noise, nonlinearity, and constant evolution. Thus, modeling them is extremely hard. We address the task of generating realistic and responsive Limit Order Book (LOB) market simulations, which are fundamental for calibrating and testing trading strategies, performing market impact experiments, and generating synthetic market data. Previous works lack realism, usefulness, and responsiveness of the generated simulations. To bridge this gap, we propose a novel TRAnsformer-based Denoising Diffusion Probabilistic Engine for LOB Simulations (TRADES). TRADES generates realistic order flows conditioned on the state of the market, leveraging a transformer-based architecture that captures the temporal and spatial characteristics of high-frequency market data. There is a notable absence of quantitative metrics for evaluating generative market simulation models in the literature. To tackle this problem, we adapt the predictive score, a metric measured as an MAE, by training a stock price predictive model on synthetic data and testing it on real data. We compare TRADES with previous works on two stocks, reporting an x3.27 and x3.47 improvement over SoTA according to the predictive score, demonstrating that we generate useful synthetic market data for financial downstream tasks. We assess TRADES's market simulation realism and responsiveness, showing that it effectively learns the conditional data distribution and successfully reacts to an experimental agent, giving sprout to possible calibrations and evaluations of trading strategies and market impact experiments. We developed DeepMarket, the first open-source Python framework for market simulation with deep learning. Our repository includes a synthetic LOB dataset composed of TRADES's generates simulations. We release the code at github.com/LeonardoBerti00/DeepMarket.

AI Key Findings

Generated Jun 12, 2025

Methodology

The research proposes TRADES, a Transformer-based Denoising Diffusion Probabilistic Engine for Limit Order Book (LOB) Simulations, utilizing a transformer-based architecture to capture temporal and spatial characteristics of high-frequency market data. TRADES generates realistic order flows conditioned on the state of the market, addressing the lack of realism in previous works.

Key Results

- TRADES outperforms state-of-the-art methods by a factor of ×3.27 and ×3.48 on Tesla and Intel stocks, according to the predictive score metric.

- TRADES covers 67.04% of the real data distribution, surpassing IABS (52.92%) and CGAN (57.49%), as shown by PCA analysis.

- TRADES demonstrates responsiveness to external agents, enabling counterfactual and market impact experiments.

- The DeepMarket framework, developed alongside TRADES, is the first open-source Python framework for market simulation with deep learning, offering various features such as pre-processing, training environment, hyperparameter search, and synthetic LOB dataset generation.

Significance

This research is significant as it presents TRADES, a novel method for generating realistic and responsive market simulations, which is crucial for calibrating and testing trading strategies, performing market impact experiments, and generating synthetic market data.

Technical Contribution

The main technical contribution is the development of TRADES, a transformer-based denoising diffusion probabilistic engine for generating realistic LOB market simulations, along with the DeepMarket open-source Python framework for market simulations with deep learning.

Novelty

TRADES stands out by effectively combining a transformer-based architecture with denoising diffusion models to capture temporal and spatial characteristics of high-frequency market data, resulting in more realistic and responsive market simulations compared to previous works.

Limitations

- The study does not compare TRADES with other state-of-the-art methods due to the unavailability of open-source implementations and insufficient details to reproduce results.

- The evaluation of generated market simulations relies on the predictive score metric, which might not capture all aspects of realism.

Future Work

- Further testing is required to have a mature evaluation protocol for trading strategies.

- Exploration of additional stylized facts and financial features to enhance the realism of generated market simulations.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRealistic Noise Synthesis with Diffusion Models

Qi Wu, Mingyan Han, Ting Jiang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)