Summary

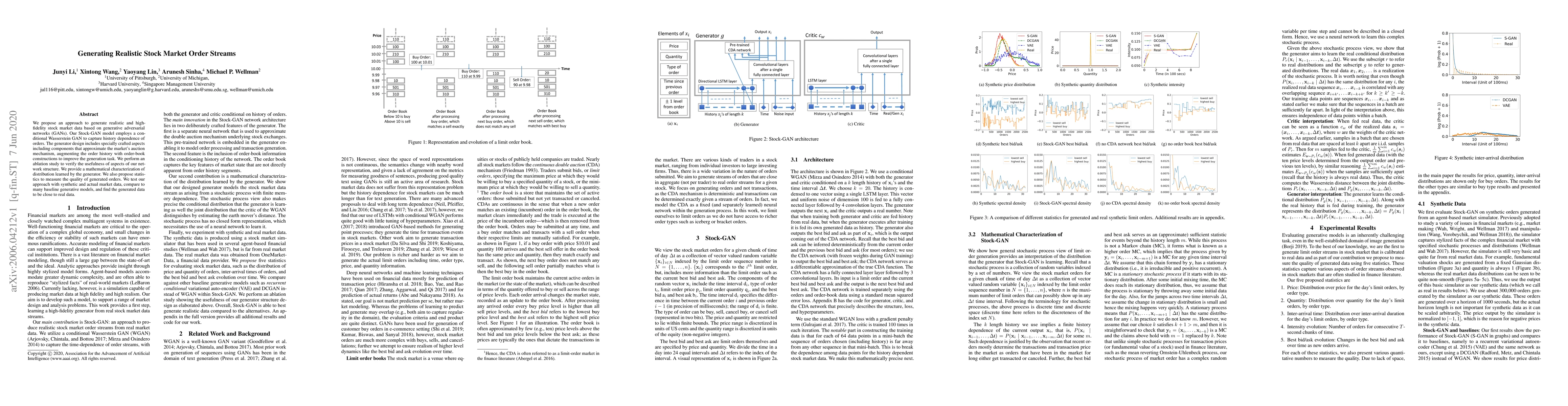

We propose an approach to generate realistic and high-fidelity stock market data based on generative adversarial networks (GANs). Our Stock-GAN model employs a conditional Wasserstein GAN to capture history dependence of orders. The generator design includes specially crafted aspects including components that approximate the market's auction mechanism, augmenting the order history with order-book constructions to improve the generation task. We perform an ablation study to verify the usefulness of aspects of our network structure. We provide a mathematical characterization of distribution learned by the generator. We also propose statistics to measure the quality of generated orders. We test our approach with synthetic and actual market data, compare to many baseline generative models, and find the generated data to be close to real data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTRADES: Generating Realistic Market Simulations with Diffusion Models

Bardh Prenkaj, Paola Velardi, Leonardo Berti

MASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)