Summary

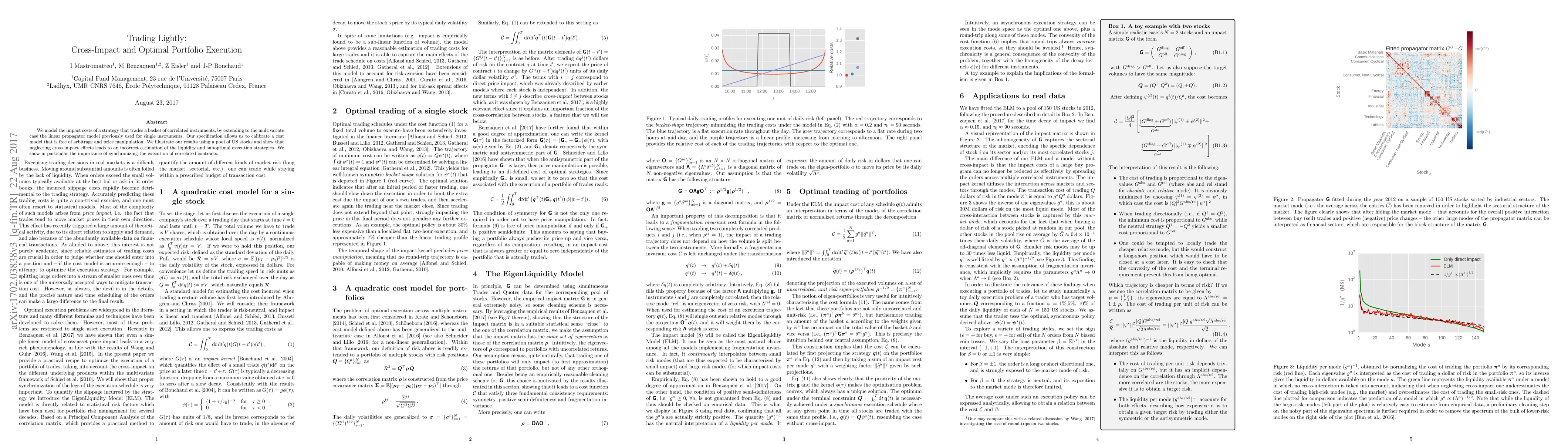

We model the impact costs of a strategy that trades a basket of correlated instruments, by extending to the multivariate case the linear propagator model previously used for single instruments. Our specification allows us to calibrate a cost model that is free of arbitrage and price manipulation. We illustrate our results using a pool of US stocks and show that neglecting cross-impact effects leads to an incorrect estimation of the liquidity and suboptimal execution strategies. We show in particular the importance of synchronizing the execution of correlated contracts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)