Summary

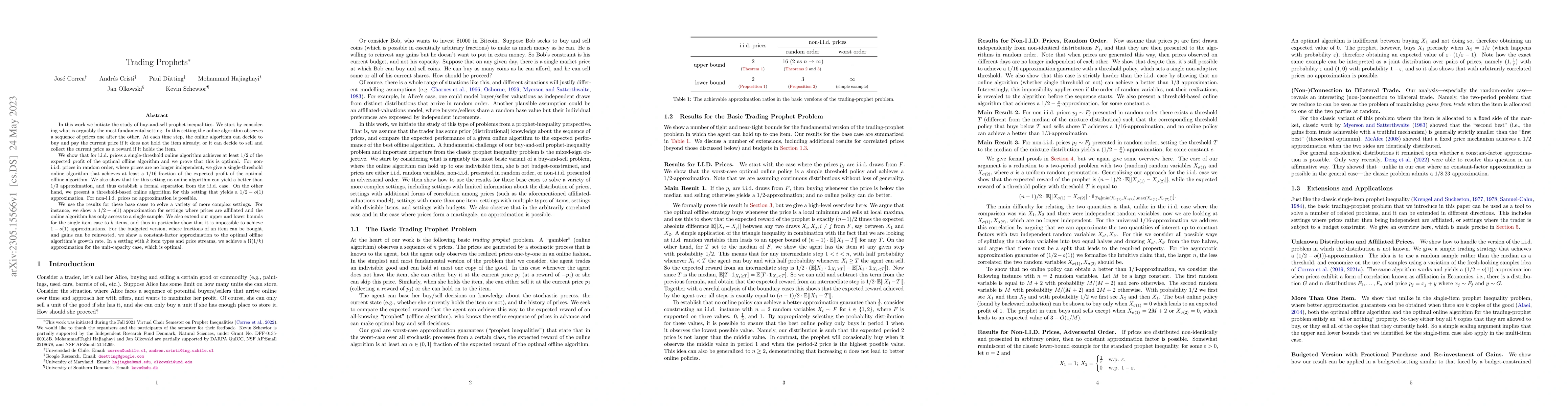

In this work we initiate the study of buy-and-sell prophet inequalities. We start by considering what is arguably the most fundamental setting. In this setting the online algorithm observes a sequence of prices one after the other. At each time step, the online algorithm can decide to buy and pay the current price if it does not hold the item already; or it can decide to sell and collect the current price as a reward if it holds the item. We show that for i.i.d. prices a single-threshold online algorithm achieves at least $1/2$ of the expected profit of the optimal offline algorithm and we prove that this is optimal. For non-i.i.d. prices in random order, where prices are no longer independent, we give a single-threshold online algorithm that achieves at least a $1/16$ fraction of the expected profit of the optimal offline algorithm. We also show that for this setting no online algorithm can yield a better than $1/3$ approximation, and thus establish a formal separation from the i.i.d. case. On the other hand, we present a threshold-based online algorithm for this setting that yields a $1/2-o(1)$ approximation. For non-i.i.d. prices no approximation is possible. We use the results for these base cases to solve a variety of more complex settings. For instance, we show a $1/2-o(1)$ approximation for settings where prices are affiliated and the online algorithm has only access to a single sample. We also extend our upper and lower bounds for the single item case to $k$ items, and thus in particular show that it is impossible to achieve $1-o(1)$ approximations. For the budgeted version, where fractions of an item can be bought, and gains can be reinvested, we show a constant-factor approximation to the optimal offline algorithm's growth rate. In a setting with $k$ item types and price streams, we achieve a $\Omega(1/k)$ approximation for the unit-capacity case, which is optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrading Prophets: How to Trade Multiple Stocks Optimally

Rohit Vaish, Ashish Chiplunkar, Surbhi Rajput

| Title | Authors | Year | Actions |

|---|

Comments (0)