Summary

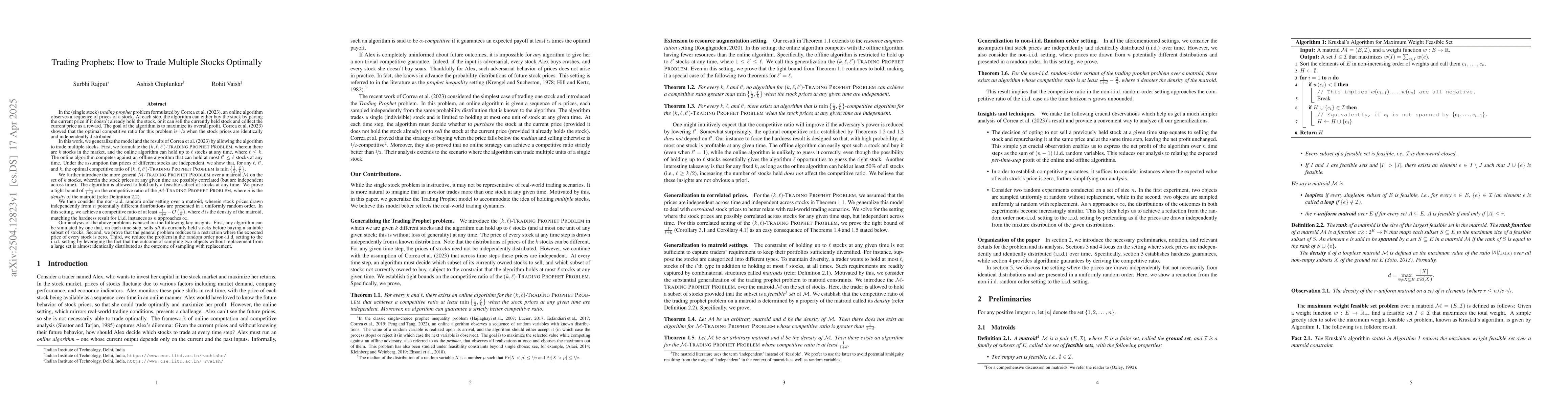

In the single stock trading prophet problem formulated by Correa et al.\ (2023), an online algorithm observes a sequence of prices of a stock. At each step, the algorithm can either buy the stock by paying the current price if it doesn't already hold the stock, or it can sell the currently held stock and collect the current price as a reward. The goal of the algorithm is to maximize its overall profit. In this work, we generalize the model and the results of Correa et al.\ by allowing the algorithm to trade multiple stocks. First, we formulate the $(k,\ell,\ell')$-Trading Prophet Problem, wherein there are $k$ stocks in the market, and the online algorithm can hold up to $\ell$ stocks at any time, where $\ell\leq k$. The online algorithm competes against an offline algorithm that can hold at most $\ell'\leq\ell$ stocks at any time. Under the assumption that prices of different stocks are independent, we show that, for any $\ell$, $\ell'$, and $k$, the optimal competitive ratio of $(k,\ell,\ell')$-Trading Prophet Problem is $\min(1/2,\ell/k)$. We further introduce the more general $\cal{M}$-Trading Prophet Problem over a matroid $\cal{M}$ on the set of $k$ stocks, wherein the stock prices at any given time are possibly correlated (but are independent across time). The algorithm is allowed to hold only a feasible subset of stocks at any time. We prove a tight bound of $1/(1+d)$ on the competitive ratio of the $\cal{M}$-Trading Prophet Problem, where $d$ is the density of the matroid. We then consider the non-i.i.d.\ random order setting over a matroid, wherein stock prices drawn independently from $n$ potentially different distributions are presented in a uniformly random order. In this setting, we achieve a competitive ratio of at least $1/(1+d)-\cal{O}(1/n)$, where $d$ is the density of the matroid, matching the hardness result for i.i.d.\ instances as $n$ approaches $\infty$.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper generalizes the single stock trading prophet problem to multiple stocks under matroid constraints, analyzing both independent and identically distributed (i.i.d.) and non-i.i.d. random order scenarios. It introduces and solves the $(k,\ell,\ell')$-Trading Prophet Problem and the $\cal{M}$-Trading Prophet Problem, deriving competitive ratios for each case.

Key Results

- The optimal competitive ratio for the $(k,\ell,\ell')$-Trading Prophet Problem is $\min(1/2,\ell/k)$ when stock prices are independent.

- For the $\cal{M}$-Trading Prophet Problem with correlated stock prices, the competitive ratio is bounded by $1/(1+d)$, where $d$ is the density of the matroid.

- In the non-i.i.d. random order setting, the competitive ratio is shown to be at least $1/(1+d) - \mathcal{O}(1/n)$, matching the hardness result for i.i.d. instances as $n$ approaches infinity.

- Algorithm 2 is proven to be $(1+d)/d$-competitive for arbitrary matroids with correlated distributions.

- Algorithm 2 is shown to be $\min(1/2, \ell/k)$-competitive for the (k, ℓ, ℓ')-Trading Prophet Problem when distributions are i.i.d.

Significance

This research extends the trading prophet problem to multiple stocks, providing a comprehensive analysis of competitive ratios under various constraints, which is crucial for developing optimal trading strategies in financial markets.

Technical Contribution

The paper introduces and solves the generalized trading prophet problem for multiple stocks under matroid constraints, providing tight competitive ratio bounds for both i.i.d. and non-i.i.d. price scenarios.

Novelty

The work extends previous research by Correa et al. (2023) to multiple stocks, generalizing the problem and deriving novel competitive ratio bounds for various matroid and distribution settings.

Limitations

- The analysis primarily focuses on matroid constraints and may not directly apply to other types of constraints.

- The results are based on specific assumptions (e.g., independent or identically distributed prices) that might not always hold in real-world scenarios.

Future Work

- Investigate the performance of trading algorithms under more complex, non-matroid constraints.

- Explore the applicability of these results to dynamic markets with time-varying parameters.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)