Authors

Summary

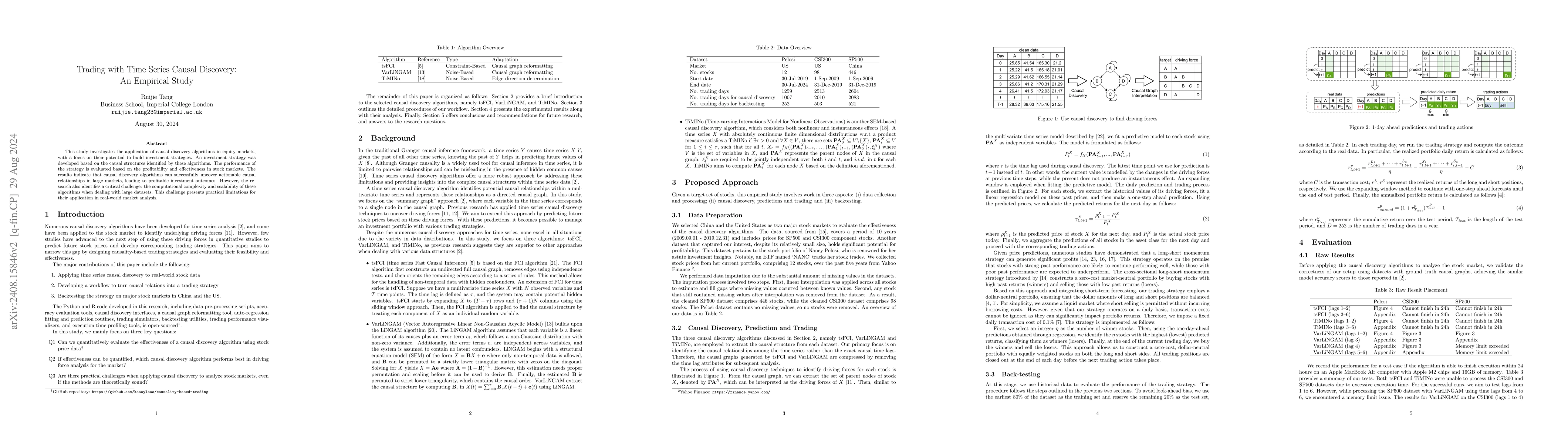

This study investigates the application of causal discovery algorithms in equity markets, with a focus on their potential to build investment strategies. An investment strategy was developed based on the causal structures identified by these algorithms. The performance of the strategy is evaluated based on the profitability and effectiveness in stock markets. The results indicate that causal discovery algorithms can successfully uncover actionable causal relationships in large markets, leading to profitable investment outcomes. However, the research also identifies a critical challenge: the computational complexity and scalability of these algorithms when dealing with large datasets. This challenge presents practical limitations for their application in real-world market analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausal Discovery from Conditionally Stationary Time Series

Carles Balsells-Rodas, Yingzhen Li, Ruibo Tu et al.

Causal Discovery from Subsampled Time Series with Proxy Variables

Xinwei Sun, Yizhou Wang, Mingzhou Liu et al.

No citations found for this paper.

Comments (0)