Summary

Organizations typically train large models individually. This is costly and time-consuming, particularly for large-scale foundation models. Such vertical production is known to be suboptimal. Inspired by this economic insight, we ask whether it is possible to leverage others' expertise by trading the constituent parts in models, i.e., sets of weights, as if they were market commodities. While recent advances in aligning and interpolating models suggest that doing so may be possible, a number of fundamental questions must be answered to create viable parameter markets. In this work, we address these basic questions, propose a framework containing the infrastructure necessary for market operations to take place, study strategies for exchanging parameters, and offer means for agents to monetize parameters. Excitingly, compared to agents who train siloed models from scratch, we show that it is possible to mutually gain by using the market, even in competitive settings. This suggests that the notion of parameter markets may be a useful paradigm for improving large-scale model training in the future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

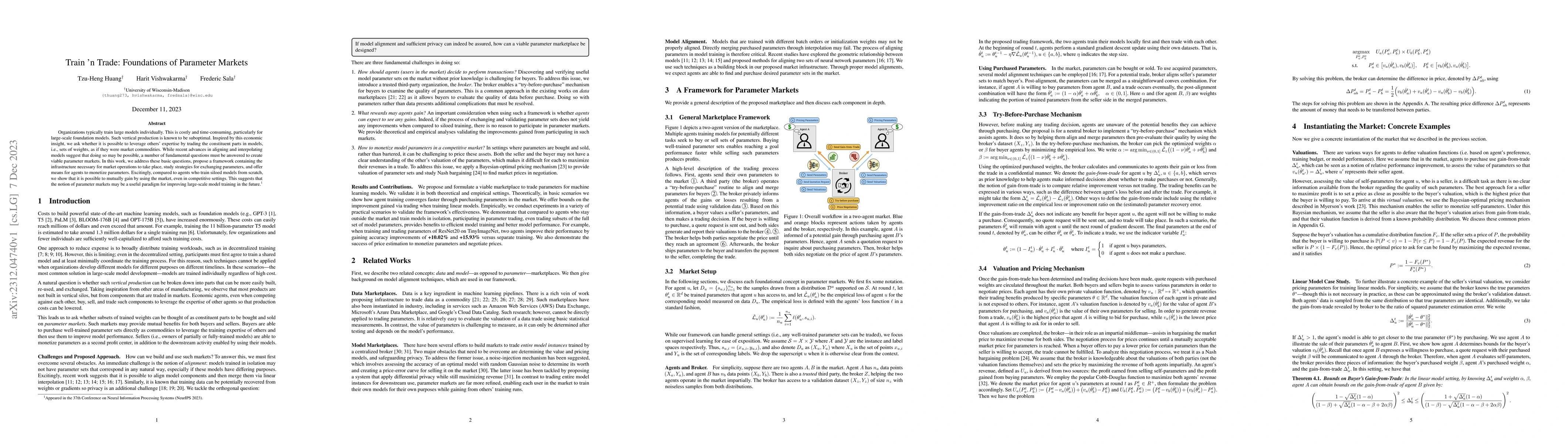

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)