Summary

This paper analizes the optimal level of transfer pricing manipulation when the expected tax penalty is a function of the tax enforcement and the market price parameter. The arm's length principle implies the existence of a range of acceptable prices shaped by market, and firms can manipulate transfer prices more freely if market price range is wide, or if its delimitations are difficult to determine. Home taxation of foreign profits can reduce income shifting incentive, depending on the portion of repatriation for tax purposes. We find that the limited tax credit rule tends to be a less efficient measure, nonetheless it is the most widely adopted rule by countries, so to spark the perspective of more powerful approaches for taxation of foreign profits.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

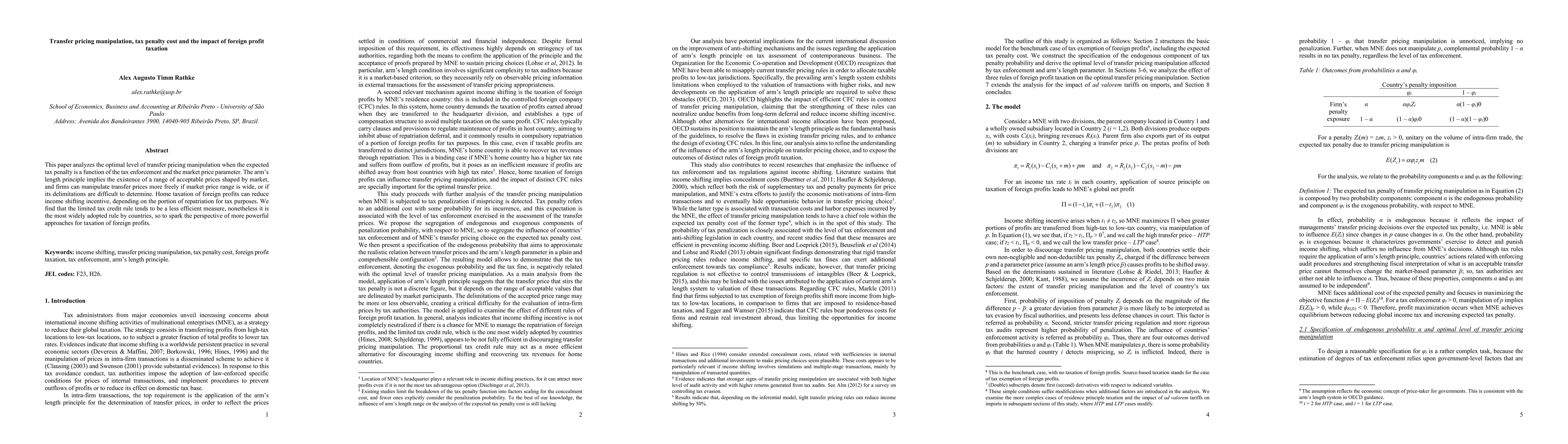

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEconomic Integration and Agglomeration of Multinational Production with Transfer Pricing

Hayato Kato, Hirofumi Okoshi

Germany's Tax Revenue and its Total Administrative Cost

Christopher Mantzaris, Ajda Fošner

| Title | Authors | Year | Actions |

|---|

Comments (0)