Summary

To the naked eye, stock prices are considered chaotic, dynamic, and unpredictable. Indeed, it is one of the most difficult forecasting tasks that hundreds of millions of retail traders and professional traders around the world try to do every second even before the market opens. With recent advances in the development of machine learning and the amount of data the market generated over years, applying machine learning techniques such as deep learning neural networks is unavoidable. In this work, we modeled the task as a multivariate forecasting problem, instead of a naive autoregression problem. The multivariate analysis is done using the attention mechanism via applying a mutated version of the Transformer, "Stockformer", which we created.

AI Key Findings

Generated Jun 13, 2025

Methodology

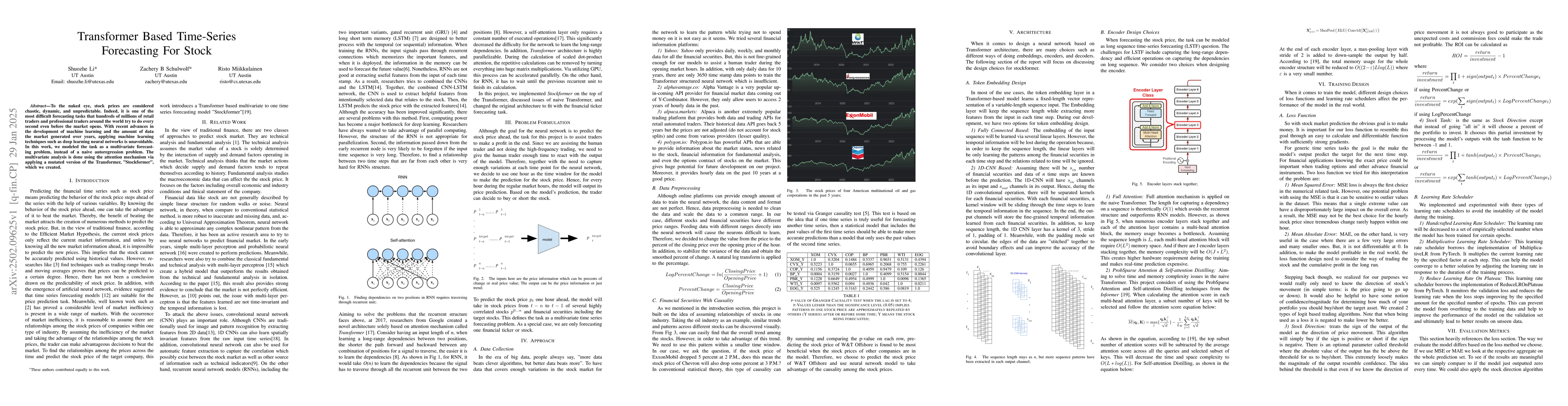

The research models stock price forecasting as a multivariate time-series problem using a Transformer-based architecture called 'Stockformer'. It employs a mutated version of the Transformer with attention mechanisms, handling financial data from platforms like Alpaca.markets and Polygon.io, focusing on hourly data over a 10-year period.

Key Results

- Stockformer outperforms traditional LSTM in profit-making for stock price forecasting.

- ProbSparseAttention, a technique from Informer, generalizes well for stock price prediction, offering better time and space complexity than FullAttention.

- The model's performance improves with larger embedding sizes and more attention heads, indicating a relationship between the two parameters.

- Including more financial tickers and implementing dynamic training based on the latest data can enhance the model's profitability.

Significance

This research contributes to the application of advanced Transformer architectures in financial forecasting, potentially improving prediction accuracy and offering insights into causal relationships among stock prices.

Technical Contribution

The development and application of Stockformer, a Transformer-based model tailored for financial time-series forecasting, incorporating ProbSparseAttention for improved efficiency.

Novelty

This work introduces Stockformer, a novel application of Transformer architecture to stock price forecasting, and demonstrates the effectiveness of ProbSparseAttention for handling long financial time-series data.

Limitations

- Transformers were harder to train than anticipated, with learning rate selection and scheduling significantly impacting model performance.

- Limited by computing power, the study could not extensively test various hyperparameters and architectures.

Future Work

- Explore additional financial tickers and alternative indicators to enhance model robustness.

- Implement dynamic training by retraining the model periodically with the latest data to capture evolving market patterns.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDouble-Path Adaptive-correlation Spatial-Temporal Inverted Transformer for Stock Time Series Forecasting

Wenbo Yan, Ying Tan

MASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

No citations found for this paper.

Comments (0)