Authors

Summary

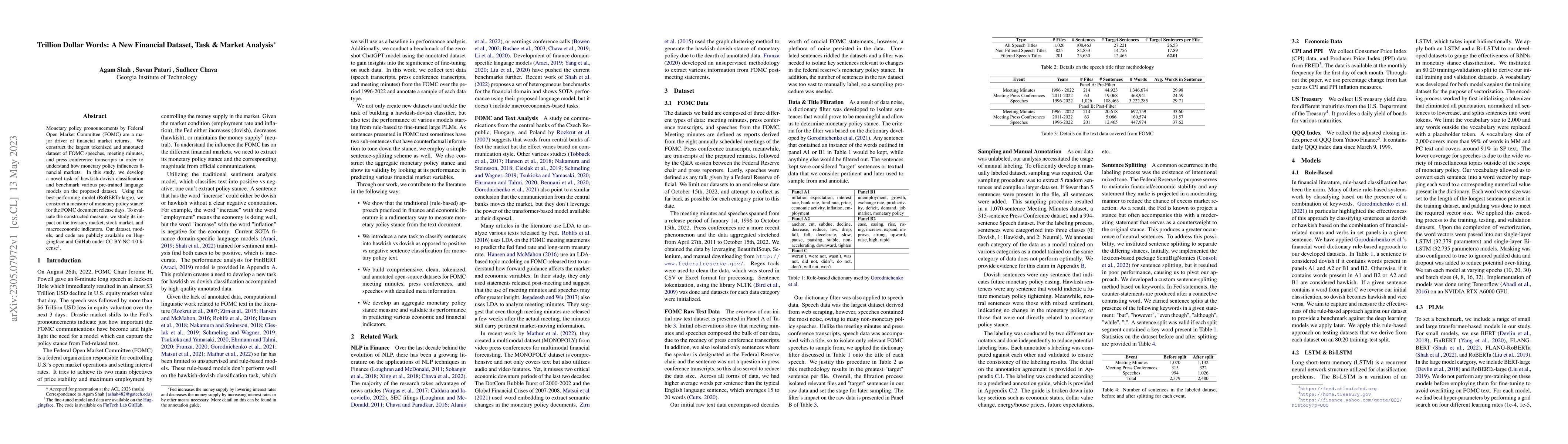

Monetary policy pronouncements by Federal Open Market Committee (FOMC) are a major driver of financial market returns. We construct the largest tokenized and annotated dataset of FOMC speeches, meeting minutes, and press conference transcripts in order to understand how monetary policy influences financial markets. In this study, we develop a novel task of hawkish-dovish classification and benchmark various pre-trained language models on the proposed dataset. Using the best-performing model (RoBERTa-large), we construct a measure of monetary policy stance for the FOMC document release days. To evaluate the constructed measure, we study its impact on the treasury market, stock market, and macroeconomic indicators. Our dataset, models, and code are publicly available on Huggingface and GitHub under CC BY-NC 4.0 license.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNumerical Claim Detection in Finance: A New Financial Dataset, Weak-Supervision Model, and Market Analysis

Anushka Singh, Agam Shah, Sudheer Chava et al.

Cryptocurrency Bubble Detection: A New Stock Market Dataset, Financial Task & Hyperbolic Models

Paolo Rosso, Sudheer Chava, Vivek Mittal et al.

The Financial Market of Environmental Indices

Frank J. Fabozzi, Abootaleb Shirvani, Svetlozar Rachev et al.

More than Words: Twitter Chatter and Financial Market Sentiment

Travis Adams, Andrea Ajello, Diego Silva et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)