Summary

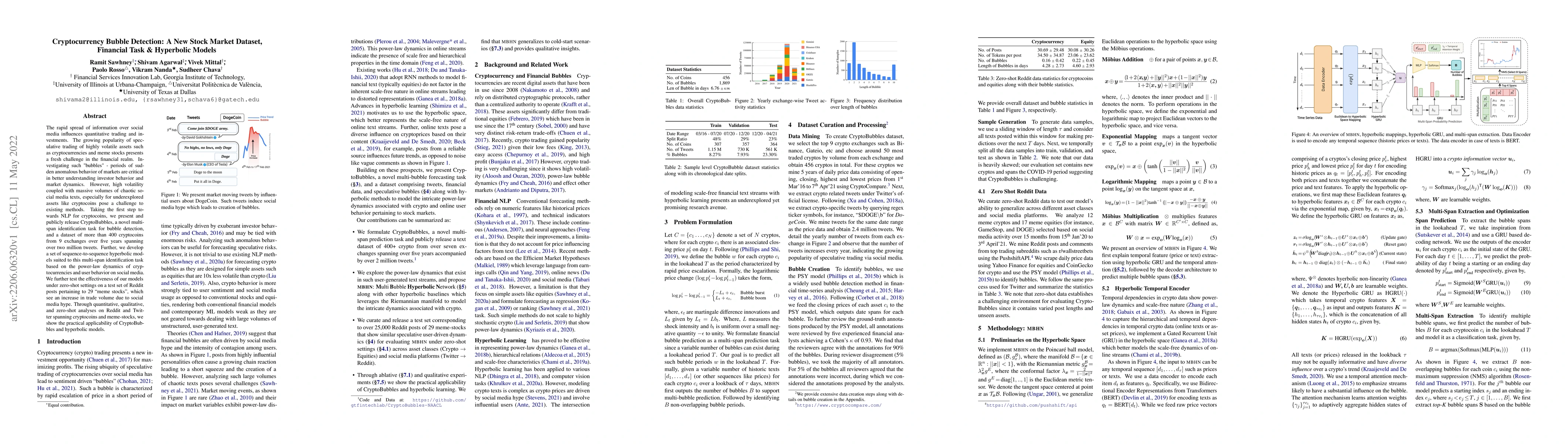

The rapid spread of information over social media influences quantitative trading and investments. The growing popularity of speculative trading of highly volatile assets such as cryptocurrencies and meme stocks presents a fresh challenge in the financial realm. Investigating such "bubbles" - periods of sudden anomalous behavior of markets are critical in better understanding investor behavior and market dynamics. However, high volatility coupled with massive volumes of chaotic social media texts, especially for underexplored assets like cryptocoins pose a challenge to existing methods. Taking the first step towards NLP for cryptocoins, we present and publicly release CryptoBubbles, a novel multi-span identification task for bubble detection, and a dataset of more than 400 cryptocoins from 9 exchanges over five years spanning over two million tweets. Further, we develop a set of sequence-to-sequence hyperbolic models suited to this multi-span identification task based on the power-law dynamics of cryptocurrencies and user behavior on social media. We further test the effectiveness of our models under zero-shot settings on a test set of Reddit posts pertaining to 29 "meme stocks", which see an increase in trade volume due to social media hype. Through quantitative, qualitative, and zero-shot analyses on Reddit and Twitter spanning cryptocoins and meme-stocks, we show the practical applicability of CryptoBubbles and hyperbolic models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrillion Dollar Words: A New Financial Dataset, Task & Market Analysis

Agam Shah, Sudheer Chava, Suvan Paturi

Numerical Claim Detection in Finance: A New Financial Dataset, Weak-Supervision Model, and Market Analysis

Anushka Singh, Agam Shah, Sudheer Chava et al.

CSPRD: A Financial Policy Retrieval Dataset for Chinese Stock Market

Yong Yu, Yue Huang, Hai Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)