Authors

Summary

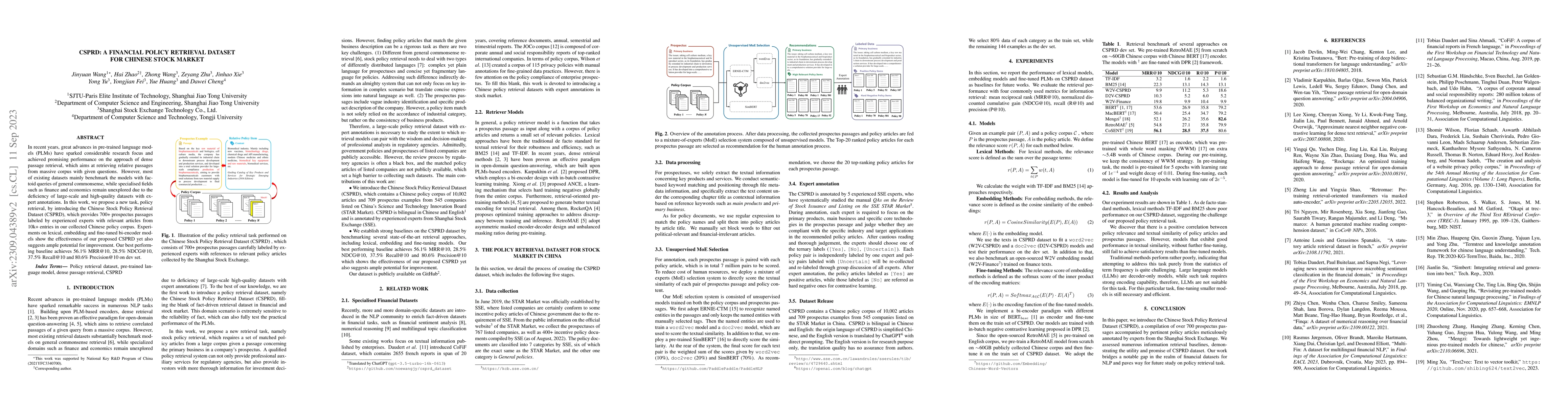

In recent years, great advances in pre-trained language models (PLMs) have sparked considerable research focus and achieved promising performance on the approach of dense passage retrieval, which aims at retrieving relative passages from massive corpus with given questions. However, most of existing datasets mainly benchmark the models with factoid queries of general commonsense, while specialised fields such as finance and economics remain unexplored due to the deficiency of large-scale and high-quality datasets with expert annotations. In this work, we propose a new task, policy retrieval, by introducing the Chinese Stock Policy Retrieval Dataset (CSPRD), which provides 700+ prospectus passages labeled by experienced experts with relevant articles from 10k+ entries in our collected Chinese policy corpus. Experiments on lexical, embedding and fine-tuned bi-encoder models show the effectiveness of our proposed CSPRD yet also suggests ample potential for improvement. Our best performing baseline achieves 56.1% MRR@10, 28.5% NDCG@10, 37.5% Recall@10 and 80.6% Precision@10 on dev set.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrillion Dollar Words: A New Financial Dataset, Task & Market Analysis

Agam Shah, Sudheer Chava, Suvan Paturi

Optimal Market Making in the Chinese Stock Market: A Stochastic Control and Scenario Analysis

Shuaiqiang Liu, Shiqi Gong, Danny D. Sun

No citations found for this paper.

Comments (0)