Summary

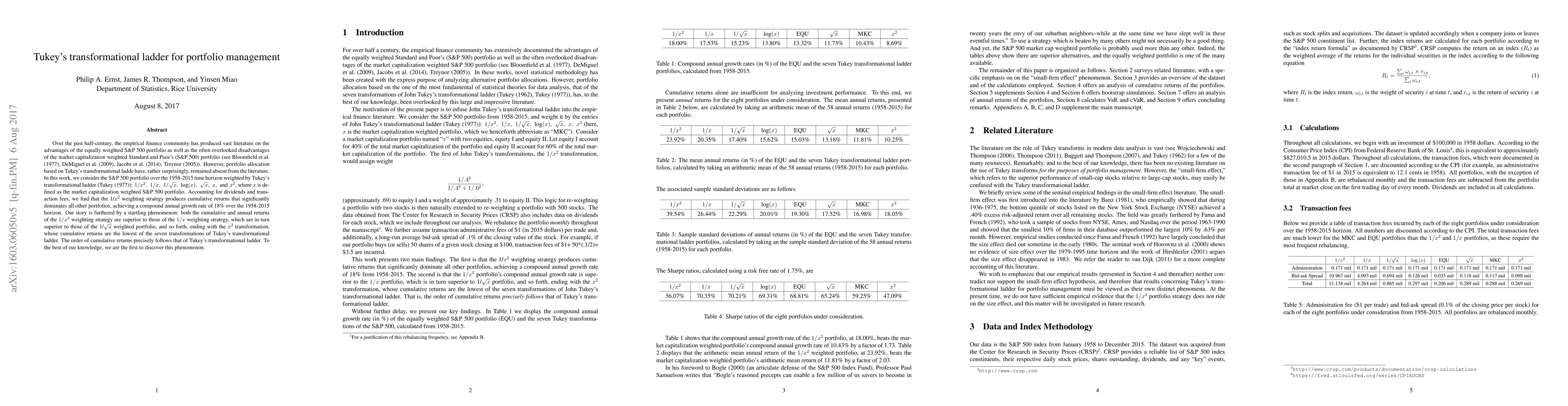

Over the past half-century, the empirical finance community has produced vast literature on the advantages of the equally weighted S\&P 500 portfolio as well as the often overlooked disadvantages of the market capitalization weighted Standard and Poor's (S\&P 500) portfolio (see \cite{Bloom}, \cite{Uppal}, \cite{Jacobs}, \cite{Treynor}). However, portfolio allocation based on Tukey's transformational ladde have, rather surprisingly, remained absent from the literature. In this work, we consider the S\&P 500 portfolio over the 1958-2015 time horizon weighted by Tukey's transformational ladder (\cite{Tukey2}): $1/x^2,\,\, 1/x,\,\, 1/\sqrt{x},\,\, \text{log}(x),\,\, \sqrt{x},\,\, x,\,\, \text{and} \,\, x^2$, where $x$ is defined as the market capitalization weighted S\&P 500 portfolio. Accounting for dividends and transaction fees, we find that the 1/$x^2$ weighting strategy produces cumulative returns that significantly dominates all other portfolios, achieving a compound annual growth rate of 18\% over the 1958-2015 horizon. Our story is furthered by a startling phenomenon: both the cumulative and annual returns of the $1/x^2$ weighting strategy are superior to those of the $1/x$ weighting strategy, which are in turn superior to those of the 1/$\sqrt{x}$ weighted portfolio, and so forth, ending with the $x^2$ transformation, whose cumulative returns are the lowest of the seven transformations of Tukey's transformational ladder. The order of cumulative returns precisely follows that of Tukey's transformational ladder. To the best of our knowledge, we are the first to discover this phenomenon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformational Outsourcing in IT Project Management

Mohammad Ikbal Hossain, Tanzina Sultana, Waheda Zabeen et al.

Market-Adaptive Ratio for Portfolio Management

Ju-Hong Lee, Bayartsetseg Kalina, KwangTek Na

| Title | Authors | Year | Actions |

|---|

Comments (0)