Summary

We investigate a dividend maximization problem under stochastic interest rates with Ornstein-Uhlenbeck dynamics. This setup also takes negative rates into account. First a deterministic time is considered, where an explicit separating curve $\alpha(t)$ can be found to determine the optimal strategy at time $t$. In a second setting we introduce a strategy-independent stopping time. The properties and behavior of these optimal control problems in both settings are analyzed in an analytical HJB-driven approach as well as using backward stochastic differential equations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

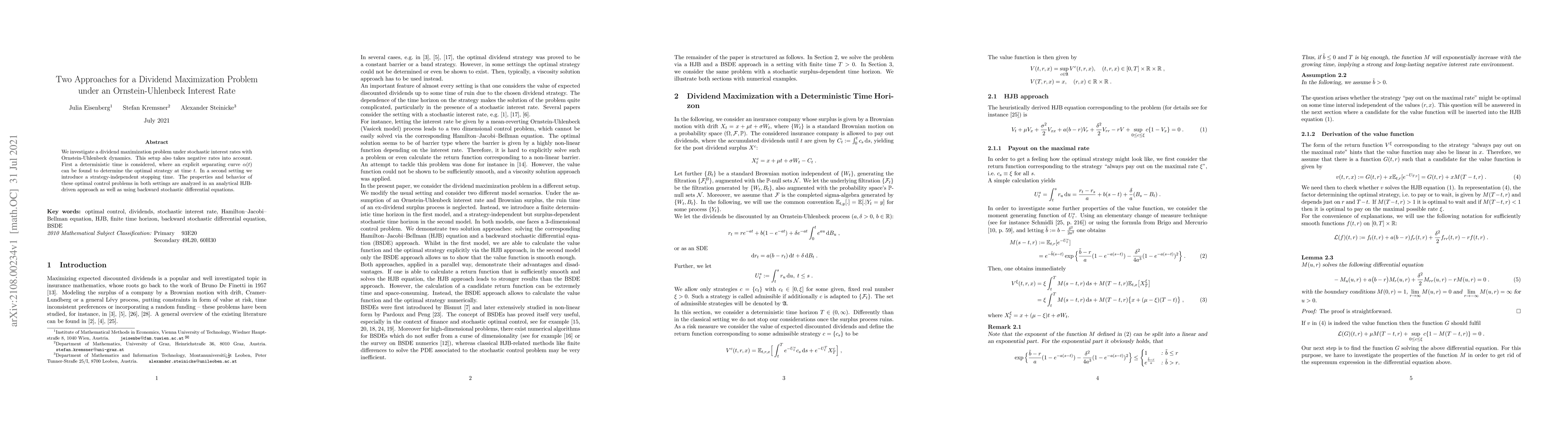

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)