Summary

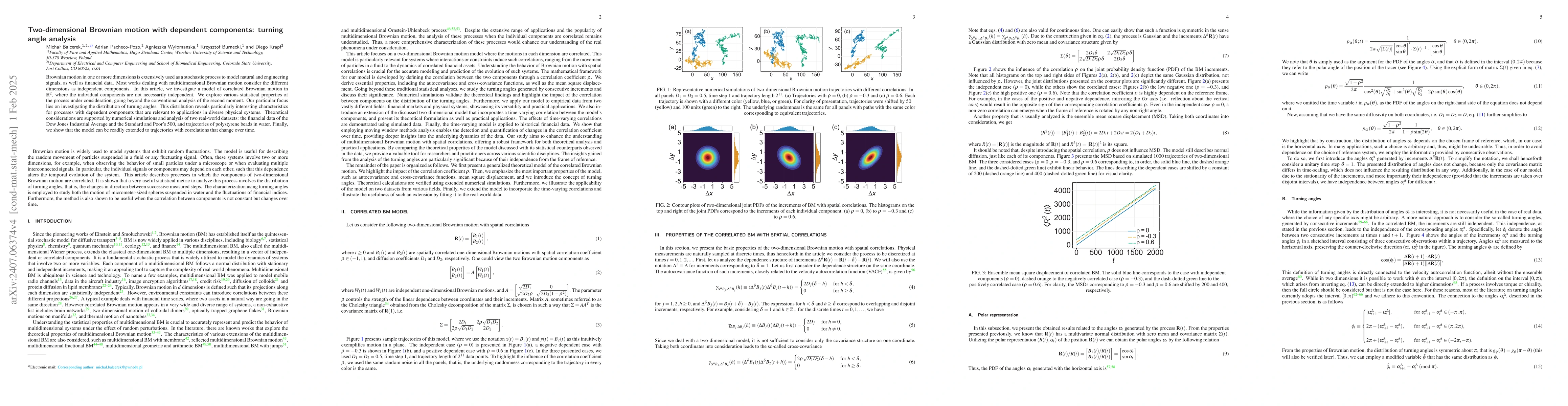

Brownian motion in one or more dimensions is extensively used as a stochastic process to model natural and engineering signals, as well as financial data. Most works dealing with multidimensional Brownian motion assume that each component is independent. In this article, we investigate a model of correlated Brownian motion in $\mathbb{R}^2$, where the individual components are not necessarily independent. We explore various statistical properties of the process under consideration, going beyond the conventional analysis of the second moment. Our particular focus lies on investigating the distribution of turning angles. This distribution reveals particularly interesting characteristics for processes with dependent components that are relevant to applications in diverse physical systems. Theoretical considerations are supported by numerical simulations and analysis of two real-world datasets: the financial data of the Dow Jones Industrial Average and the Standard and Poor's 500, and trajectories of polystyrene beads in water. Finally, we show that the model can be readily extended to trajectories with correlations that change over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)