Summary

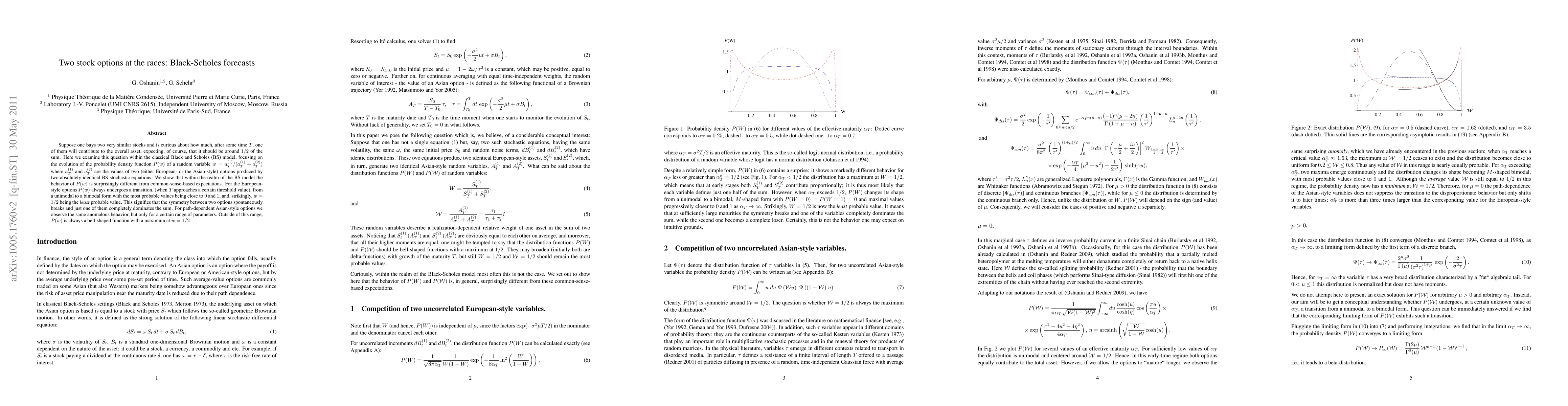

Suppose one buys two very similar stocks and is curious about how much, after some time T, one of them will contribute to the overall asset, expecting, of course, that it should be around 1/2 of the sum. Here we examine this question within the classical Black and Scholes (BS) model, focusing on the evolution of the probability density function P(w) of a random variable w = a_T^{(1)}/(a_T^{(1)} + a_T^{(2)}) where a_T^{(1)} and a_T^{(2)} are the values of two (either European- or the Asian-style) options produced by two absolutely identical BS stochastic equations. We show that within the realm of the BS model the behavior of P(w) is surprisingly different from common-sense-based expectations. For the European-style options P(w) always undergoes a transition, (when T approaches a certain threshold value), from a unimodal to a bimodal form with the most probable values being close to 0 and 1, and, strikingly, w =1/2 being the least probable value. This signifies that the symmetry between two options spontaneously breaks and just one of them completely dominates the sum. For path-dependent Asian-style options we observe the same anomalous behavior, but only for a certain range of parameters. Outside of this range, P(w) is always a bell-shaped function with a maximum at w = 1/2.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting Stock Options Prices via the Solution of an Ill-Posed Problem for the Black-Scholes Equation

Michael V. Klibanov, Kirill V. Golubnichiy, Aleksander A. Shananin et al.

Neural Network Learning of Black-Scholes Equation for Option Pricing

Daniel de Souza Santos, Tiago Alessandro Espinola Ferreira

Symmetries of the Black-Scholes-Merton equation for European options

Landysh N. Bakirova, Marina A. Shurygina, Vadim V. Shurygin, Jr

| Title | Authors | Year | Actions |

|---|

Comments (0)