Authors

Summary

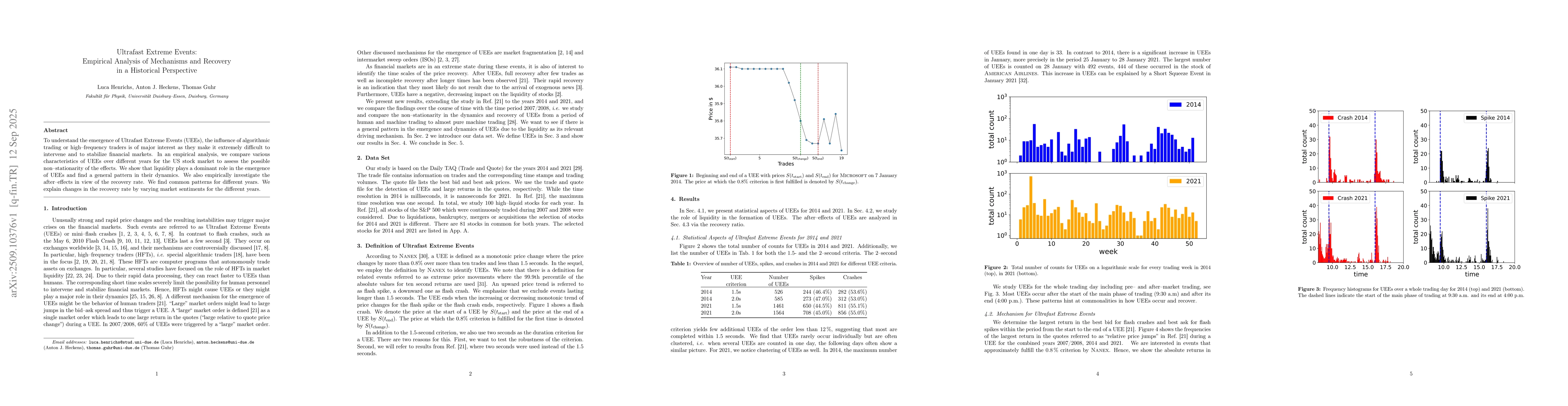

To understand the emergence of Ultrafast Extreme Events (UEEs), the influence of algorithmic trading or high-frequency traders is of major interest as they make it extremely difficult to intervene and to stabilize financial markets. In an empirical analysis, we compare various characteristics of UEEs over different years for the US stock market to assess the possible non-stationarity of the effects. We show that liquidity plays a dominant role in the emergence of UEEs and find a general pattern in their dynamics. We also empirically investigate the after-effects in view of the recovery rate. We find common patterns for different years. We explain changes in the recovery rate by varying market sentiments for the different years.

AI Key Findings

Generated Oct 18, 2025

Methodology

The study employs an empirical analysis of Ultrafast Extreme Events (UEEs) in the US stock market across multiple years (2007/2008, 2014, 2021) to assess non-stationarity. It uses frequency histograms, contour plots, and recovery ratio analysis to compare liquidity, market sentiment, and recovery patterns.

Key Results

- Liquidity is identified as the dominant factor in the emergence of UEEs, with consistent patterns observed across different years.

- Recovery rates vary by market sentiment, with flash crashes and spikes showing distinct recovery behaviors in 2021 compared to earlier years.

- The statistical properties of UEEs are robust and universal, remaining largely unchanged despite varying criteria for event detection.

Significance

This research provides critical insights into the mechanisms and recovery dynamics of UEEs, highlighting the role of liquidity and market sentiment. It aids in understanding financial market stability and the impact of algorithmic trading.

Technical Contribution

The paper introduces a systematic analysis of UEEs using recovery ratios and liquidity metrics, offering a framework for understanding their formation and after-effects.

Novelty

This work extends previous studies by analyzing UEEs across multiple years and demonstrating the robustness of their statistical properties, while also exploring recovery dynamics and market sentiment impacts.

Limitations

- The analysis is limited to the US stock market, potentially missing global perspectives.

- The study relies on historical data, which may not fully capture real-time market dynamics.

Future Work

- Further studies should explore the dynamic order book mechanisms in greater detail.

- Investigating the role of human traders alongside algorithmic traders in UEEs could provide additional insights.

- Expanding the analysis to other financial markets and asset classes could enhance the generalizability of findings.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCliophysics: A scientific analysis of recurrent historical events

Yang Yang, Beomjun Kim, Qing-hai Wang et al.

Comments (0)