Summary

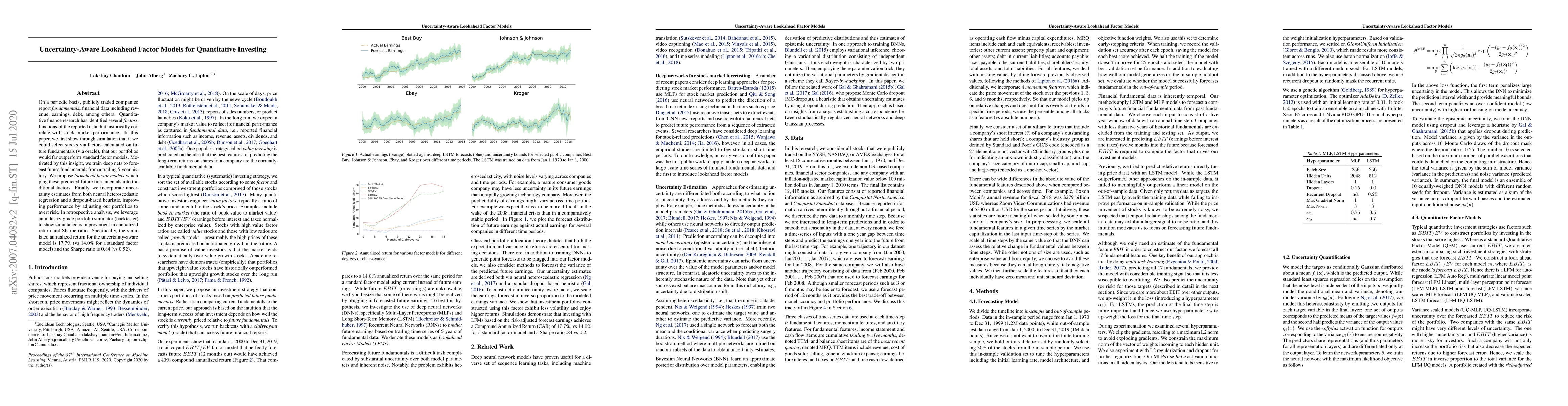

On a periodic basis, publicly traded companies report fundamentals, financial data including revenue, earnings, debt, among others. Quantitative finance research has identified several factors, functions of the reported data that historically correlate with stock market performance. In this paper, we first show through simulation that if we could select stocks via factors calculated on future fundamentals (via oracle), that our portfolios would far outperform standard factor models. Motivated by this insight, we train deep nets to forecast future fundamentals from a trailing 5-year history. We propose lookahead factor models which plug these predicted future fundamentals into traditional factors. Finally, we incorporate uncertainty estimates from both neural heteroscedastic regression and a dropout-based heuristic, improving performance by adjusting our portfolios to avert risk. In retrospective analysis, we leverage an industry-grade portfolio simulator (backtester) to show simultaneous improvement in annualized return and Sharpe ratio. Specifically, the simulated annualized return for the uncertainty-aware model is 17.7% (vs 14.0% for a standard factor model) and the Sharpe ratio is 0.84 (vs 0.52).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNavigating Uncertainty in ESG Investing

Jiayue Zhang, Ken Seng Tan, Tony S. Wirjanto et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)