Summary

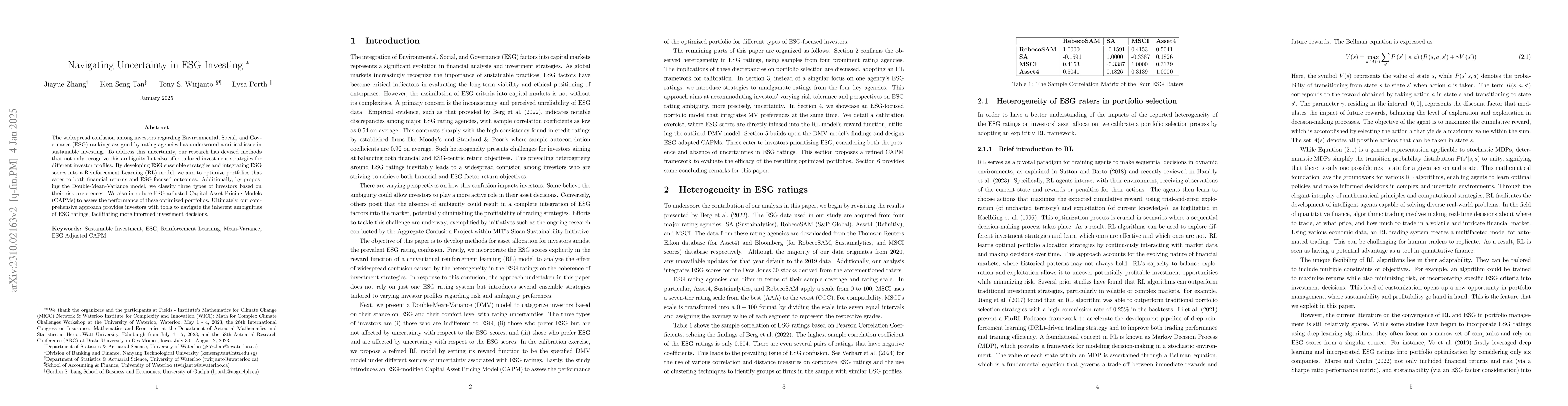

The widespread confusion among investors regarding Environmental, Social, and Governance (ESG) rankings assigned by rating agencies has underscored a critical issue in sustainable investing. To address this uncertainty, our research has devised methods that not only recognize this ambiguity but also offer tailored investment strategies for different investor profiles. By developing ESG ensemble strategies and integrating ESG scores into a Reinforcement Learning (RL) model, we aim to optimize portfolios that cater to both financial returns and ESG-focused outcomes. Additionally, by proposing the Double-Mean-Variance model, we classify three types of investors based on their risk preferences. We also introduce ESG-adjusted Capital Asset Pricing Models (CAPMs) to assess the performance of these optimized portfolios. Ultimately, our comprehensive approach provides investors with tools to navigate the inherent ambiguities of ESG ratings, facilitating more informed investment decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersESG-coherent risk measures for sustainable investing

W. Brent Lindquist, Svetlozar T. Rachev, Rosella Giacometti et al.

Crosswashing in Sustainable Investing: Unveiling Strategic Practices Impacting ESG Scores

Bertrand Kian Hassani, Yacoub Bahini

Financial Markets and ESG: How Big Data is Transforming Sustainable Investing in Developing countries

A T M Omor Faruq, Md Ataur Rahman Chowdhury

ESG-FTSE: A corpus of news articles with ESG relevance labels and use cases

Mariya Pavlova, Bernard Casey, Miaosen Wang

No citations found for this paper.

Comments (0)