Summary

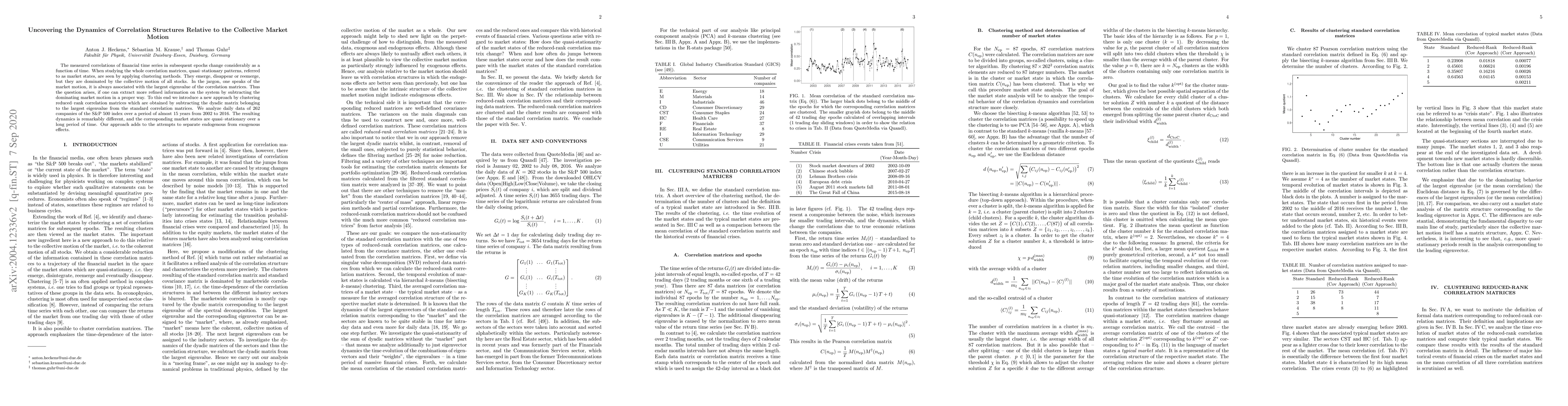

The measured correlations of financial time series in subsequent epochs change considerably as a function of time. When studying the whole correlation matrices, quasi-stationary patterns, referred to as market states, are seen by applying clustering methods. They emerge, disappear or reemerge, but they are dominated by the collective motion of all stocks. In the jargon, one speaks of the market motion, it is always associated with the largest eigenvalue of the correlation matrices. Thus the question arises, if one can extract more refined information on the system by subtracting the dominating market motion in a proper way. To this end we introduce a new approach by clustering reduced-rank correlation matrices which are obtained by subtracting the dyadic matrix belonging to the largest eigenvalue from the standard correlation matrices. We analyze daily data of 262 companies of the S&P 500 index over a period of almost 15 years from 2002 to 2016. The resulting dynamics is remarkably different, and the corresponding market states are quasi-stationary over a long period of time. Our approach adds to the attempts to separate endogenous from exogenous effects.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCollective correlations, dynamics, and behavioural inconsistencies of the cryptocurrency market over time

Nick James, Max Menzies

Filtering amplitude dependence of correlation dynamics in complex systems: application to the cryptocurrency market

Marcin Wątorek, Jarosław Kwapień, Stanisław Drożdż et al.

A New Attempt to Identify Long-term Precursors for Endogenous Financial Crises in the Market Correlation Structures

Thomas Guhr, Anton J. Heckens

| Title | Authors | Year | Actions |

|---|

Comments (0)