Authors

Summary

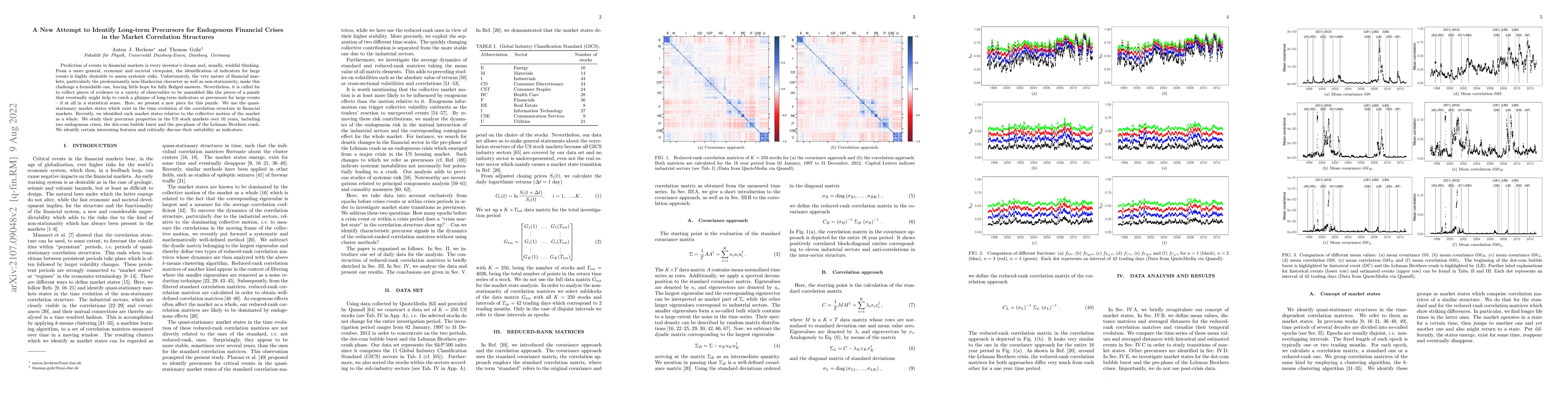

Prediction of events in financial markets is every investor's dream and, usually, wishful thinking. From a more general, economic and societal viewpoint, the identification of indicators for large events is highly desirable to assess systemic risks. Unfortunately, the very nature of financial markets, particularly the predominantly non-Markovian character as well as non-stationarity, make this challenge a formidable one, leaving little hope for fully fledged answers. Nevertheless, it is called for to collect pieces of evidence in a variety of observables to be assembled like the pieces of a puzzle that eventually might help to catch a glimpse of long-term indicators or precursors for large events - if at all in a statistical sense. Here, we present a new piece for this puzzle. We use the quasi-stationary market states which exist in the time evolution of the correlation structure in financial markets. Recently, we identified such market states relative to the collective motion of the market as a whole. We study their precursor properties in the US stock markets over 16 years, including two endogenous crises, the dot-com bubble burst and the pre-phase of the Lehman Brothers crash. We identify certain interesting features and critically discuss their suitability as indicators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Financial Market Crises using Multilayer Network Analysis and LSTM-based Forecasting of Spillover Effects

Mahdi Kohan Sefidi

| Title | Authors | Year | Actions |

|---|

Comments (0)