Authors

Summary

Signature methods have been widely and effectively used as a tool for feature extraction in statistical learning methods, notably in mathematical finance. They lack, however, interpretability: in the general case, it is unclear why signatures actually work. The present article aims to address this issue directly, by introducing and developing the concept of signature perturbations. In particular, we construct a regular perturbation of the signature of the term structure of log prices for various commodities, in terms of the convenience yield. Our perturbation expansion and rigorous convergence estimates help explain the success of signature-based classification of commodities markets according to their term structure, with the volatility of the convenience yield as the major discriminant.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper introduces signature perturbations to explain the success of signature-based classification of commodities markets, focusing on the term structure of log prices and the convenience yield's volatility as a major discriminant.

Key Results

- The signature of the term structure of log prices for various commodities can be expressed as a regular perturbation of the convenience yield's volatility.

- The perturbation expansion and convergence estimates help explain the effectiveness of signature-based classification, highlighting the convenience yield volatility as the key discriminant.

- The strongest effect among model parameters, besides the initial convenience yield, is attributed to the volatility of the convenience yield (γ).

Significance

This research bridges the gap between the interpretability and effectiveness of signature methods in statistical learning, particularly in mathematical finance, by providing a theoretical framework for understanding signature-based classification of commodities markets.

Technical Contribution

The paper develops a theory of signature approximation for commodity term structures in an appropriate normed space, embedding signatures as sequences of random variables and assigning weighted sequence norms.

Novelty

This work is novel in its direct interpretation of signature vector changes in commodity term structure returns through a perturbative expansion, establishing a concrete relationship between signature-based feature sets and model parameters of the Gibson–Schwartz model.

Limitations

- The study focuses on a regular perturbation approach for commodity futures curves, which might not be suitable for other datasets.

- The analysis assumes constant storage costs, which may not always hold in real-world scenarios.

Future Work

- Exploring multi-scale perturbation methods for other datasets to enhance interpretability.

- Investigating the impact of varying storage costs on the signature-based classification.

Paper Details

PDF Preview

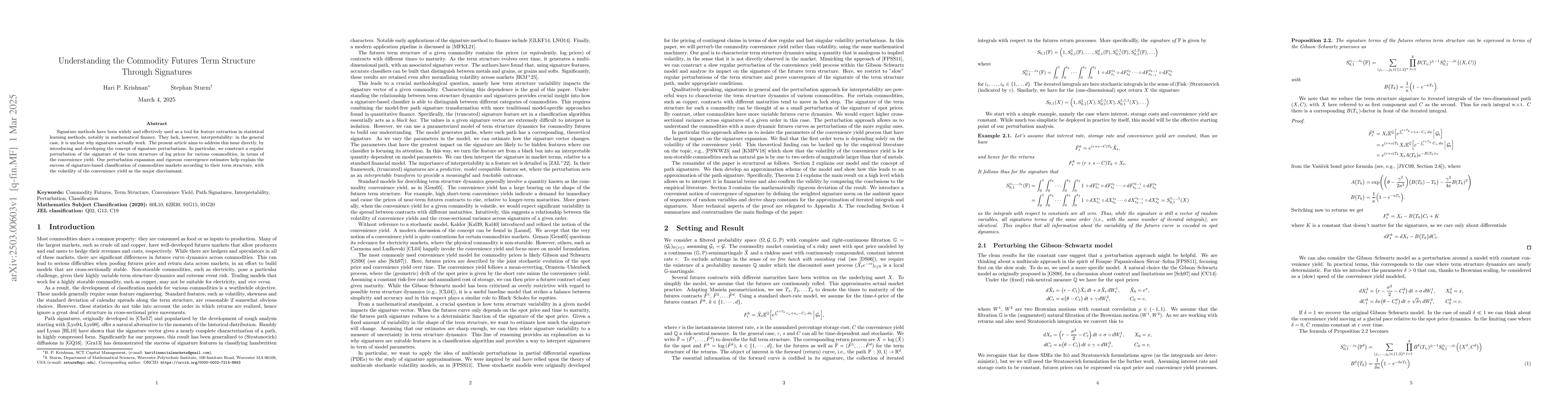

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterpolating commodity futures prices with Kriging

Andrea Pallavicini, Andrea Maran

Multi-Factor Function-on-Function Regression of Bond Yields on WTI Commodity Futures Term Structure Dynamics

Gareth W. Peters, Pavel V. Shevchenko, Peilun He et al.

Exploiting the dynamics of commodity futures curves

Robert J Bianchi, John Hua Fan, Joelle Miffre et al.

No citations found for this paper.

Comments (0)