Summary

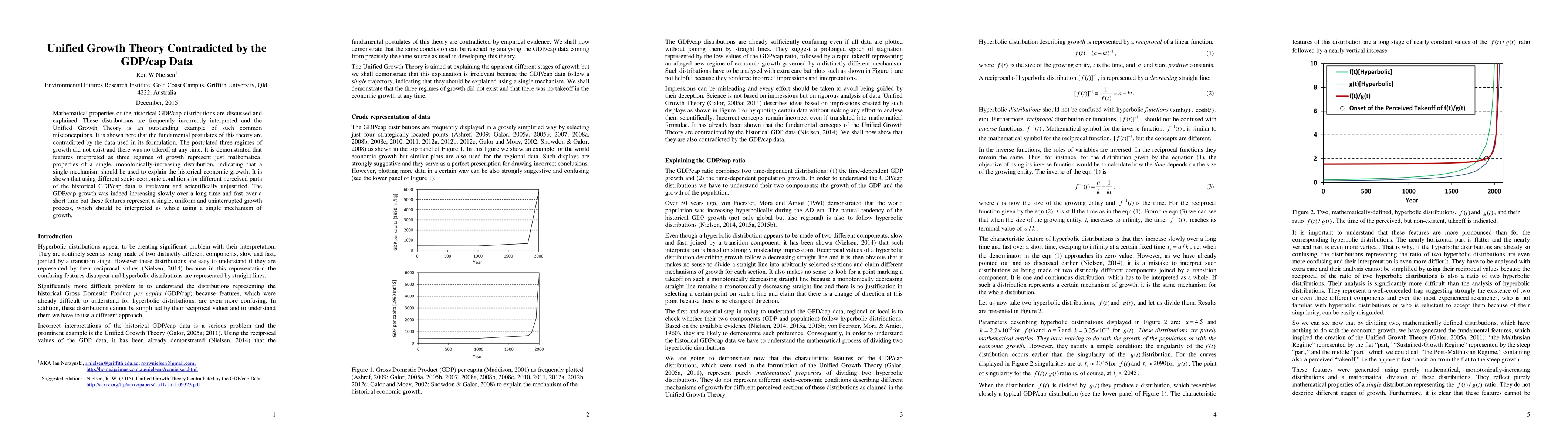

Mathematical properties of the historical GDP/cap distributions are discussed and explained. These distributions are frequently incorrectly interpreted and the Unified Growth Theory is an outstanding example of such common misconceptions. It is shown here that the fundamental postulates of this theory are contradicted by the data used in its formulation. The postulated three regimes of growth did not exist and there was no takeoff at any time. It is demonstrated that features interpreted as three regimes of growth represent just mathematical properties of a single, monotonically-increasing distribution, indicating that a single mechanism should be used to explain the historical economic growth. It is shown that using different socio-economic conditions for different perceived parts of the historical GDP/cap data is irrelevant and scientifically unjustified. The GDP/cap growth was indeed increasing slowly over a long time and fast over a short time but these features represent a single, uniform and uninterrupted growth process, which should be interpreted as whole using a single mechanism of growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)