Summary

In a model independent discrete time financial market, we discuss the richness of the family of martingale measures in relation to different notions of Arbitrage, generated by a class $\mathcal{S}$ of significant sets, which we call Arbitrage de la classe $\mathcal{S}$. The choice of $\mathcal{S}$ reflects into the intrinsic properties of the class of polar sets of martingale measures. In particular: for S=${\Omega}$ absence of Model Independent Arbitrage is equivalent to the existence of a martingale measure; for $\mathcal{S}$ being the open sets, absence of Open Arbitrage is equivalent to the existence of full support martingale measures. These results are obtained by adopting a technical filtration enlargement and by constructing a universal aggregator of all arbitrage opportunities. We further introduce the notion of market feasibility and provide its characterization via arbitrage conditions. We conclude providing a dual representation of Open Arbitrage in terms of weakly open sets of probability measures, which highlights the robust nature of this concept.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

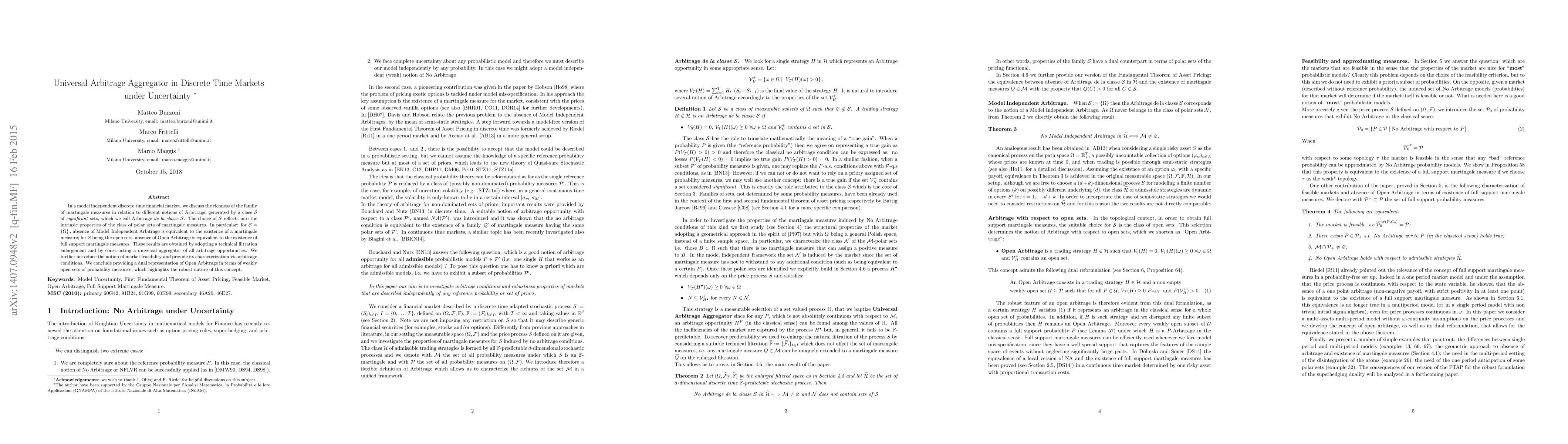

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)