Authors

Summary

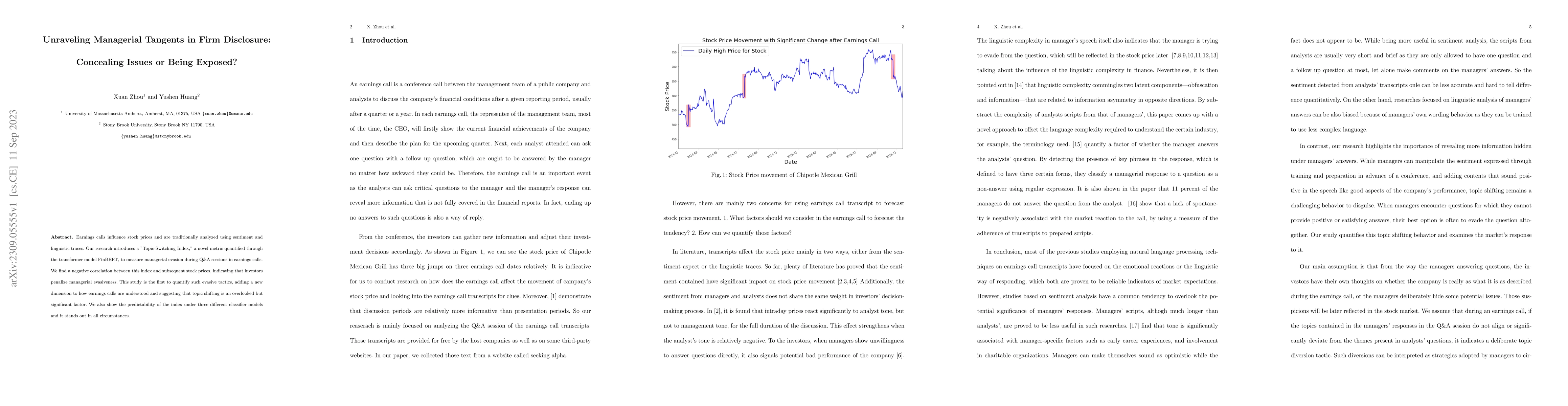

Earnings calls influence stock prices and are traditionally analyzed using sentiment and linguistic traces. Our research introduces a "Topic-Switching Index," a novel metric quantified through the transformer model FinBERT, to measure managerial evasion during Q$\&$A sessions in earnings calls. We find a negative correlation between this index and subsequent stock prices, indicating that investors penalize managerial evasiveness. This study is the first to quantify such evasive tactics, adding a new dimension to how earnings calls are understood and suggesting that topic shifting is an overlooked but significant factor. We also show the predictability of the index under three different classifier models and it stands out in all circumstances.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBeing at the core: firm product specialisation

Marco Dueñas, Filippo Bontadini, Mercedes Campi

State capital involvement, managerial sentiment and firm innovation performance Evidence from China

Xiangtai Zuo

The Kind of Silence: Managing a Reputation for Voluntary Disclosure in Financial Markets

Miles B. Gietzmann, Adam J. Ostaszewski

No citations found for this paper.

Comments (0)