Summary

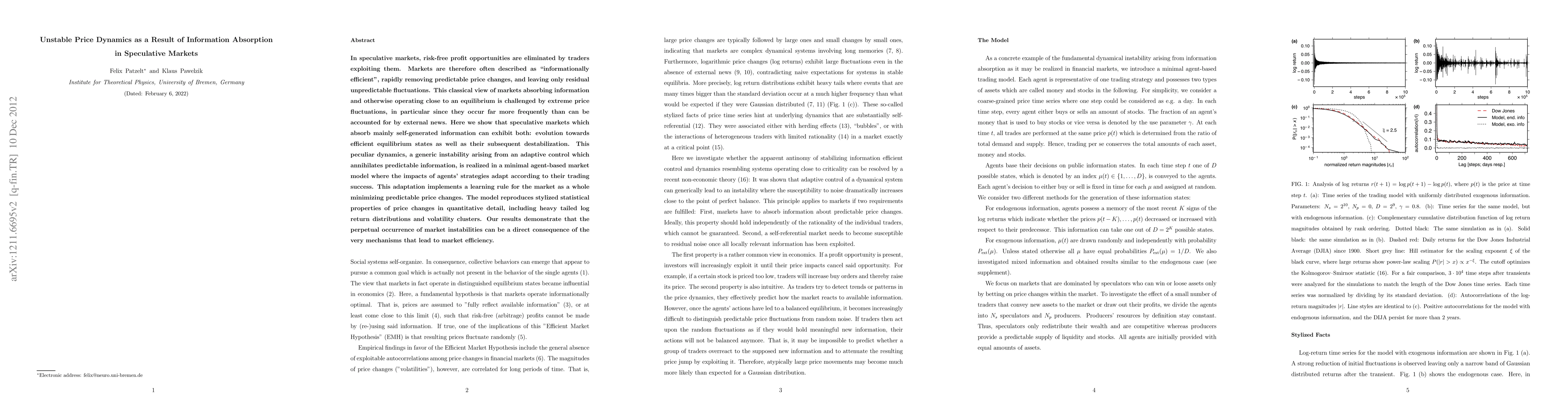

In speculative markets, risk-free profit opportunities are eliminated by traders exploiting them. Markets are therefore often described as "informationally efficient", rapidly removing predictable price changes, and leaving only residual unpredictable fluctuations. This classical view of markets absorbing information and otherwise operating close to an equilibrium is challenged by extreme price fluctuations, in particular since they occur far more frequently than can be accounted for by external news. Here we show that speculative markets which absorb mainly self-generated information can exhibit both: evolution towards efficient equilibrium states as well as their subsequent destabilization. This peculiar dynamics, a generic instability arising from an adaptive control which annihilates predictable information, is realized in a minimal agent-based market model where the impacts of agents' strategies adapt according to their trading success. This adaptation implements a learning rule for the market as a whole minimizing predictable price changes. The model reproduces stylized statistical properties of price changes in quantitative detail, including heavy tailed log return distributions and volatility clusters. Our results demonstrate that the perpetual occurrence of market instabilities can be a direct consequence of the very mechanisms that lead to market efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Classical Model of Speculative Asset Price Dynamics

Sabiou Inoua, Vernon Smith

Price Discovery in Cryptocurrency Markets

Juan Plazuelo Pascual, Carlos Tardon Rubio, Juan Toro Cebada et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)