Summary

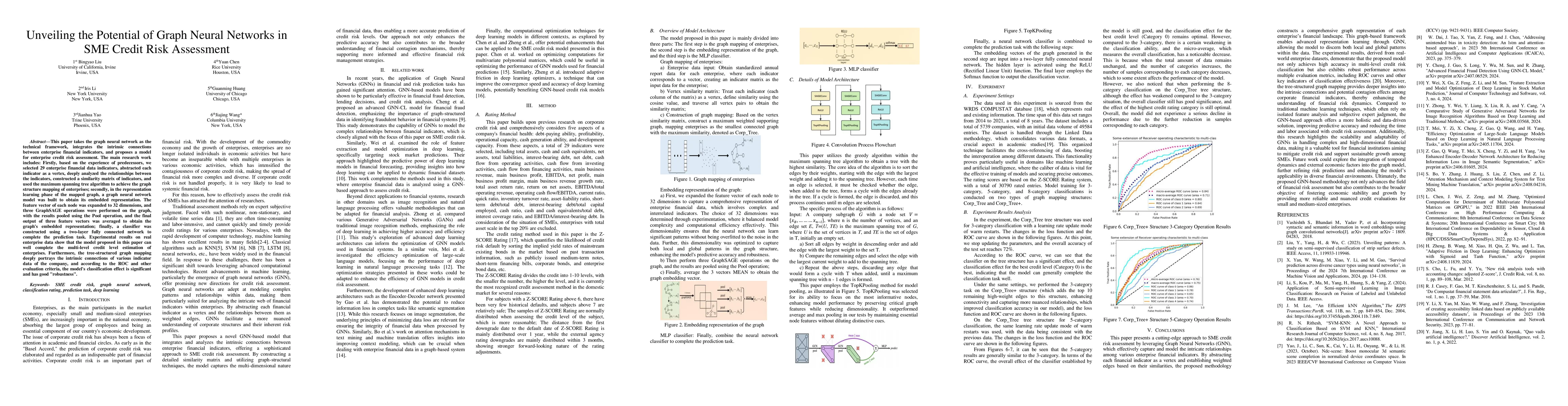

This paper takes the graph neural network as the technical framework, integrates the intrinsic connections between enterprise financial indicators, and proposes a model for enterprise credit risk assessment. The main research work includes: Firstly, based on the experience of predecessors, we selected 29 enterprise financial data indicators, abstracted each indicator as a vertex, deeply analyzed the relationships between the indicators, constructed a similarity matrix of indicators, and used the maximum spanning tree algorithm to achieve the graph structure mapping of enterprises; secondly, in the representation learning phase of the mapped graph, a graph neural network model was built to obtain its embedded representation. The feature vector of each node was expanded to 32 dimensions, and three GraphSAGE operations were performed on the graph, with the results pooled using the Pool operation, and the final output of three feature vectors was averaged to obtain the graph's embedded representation; finally, a classifier was constructed using a two-layer fully connected network to complete the prediction task. Experimental results on real enterprise data show that the model proposed in this paper can well complete the multi-level credit level estimation of enterprises. Furthermore, the tree-structured graph mapping deeply portrays the intrinsic connections of various indicator data of the company, and according to the ROC and other evaluation criteria, the model's classification effect is significant and has good "robustness".

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Risk Analysis for SMEs Using Graph Neural Networks in Supply Chain

Qianying Liu, Qinyan Shen, Zhuohuan Hu et al.

Applying Hybrid Graph Neural Networks to Strengthen Credit Risk Analysis

Zhen Xu, Mengfang Sun, Shaobo Liu et al.

Graph Dimension Attention Networks for Enterprise Credit Assessment

Yu Zhao, Fuzhen Zhuang, Shaopeng Wei et al.

Hybrid Quantum-Classical Neural Networks for Few-Shot Credit Risk Assessment

Xuan Yang, Jintao Li, Kai Xu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)