Authors

Summary

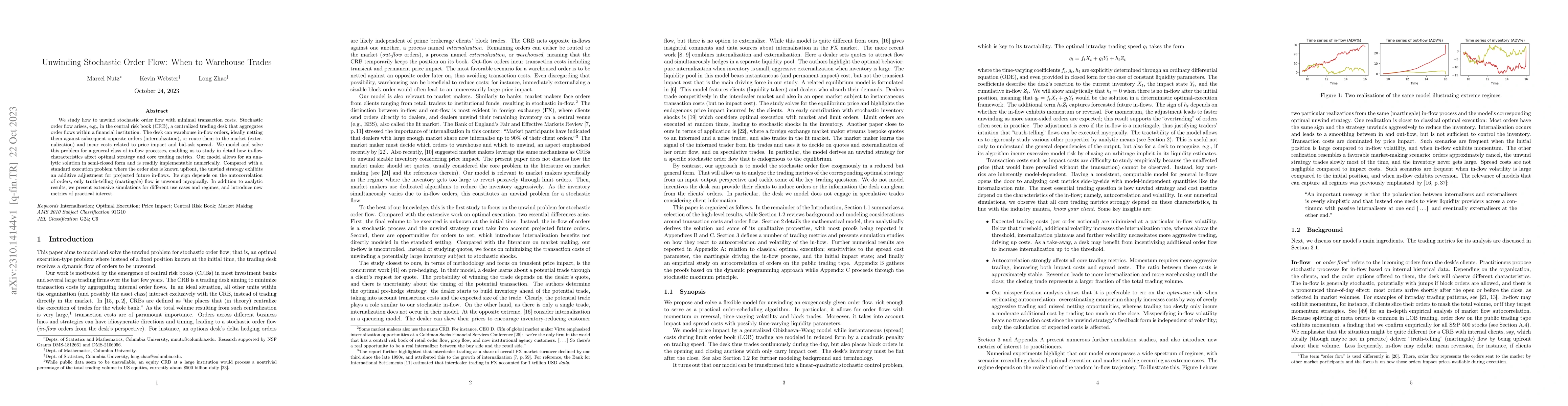

We study how to unwind stochastic order flow with minimal transaction costs. Stochastic order flow arises, e.g., in the central risk book (CRB), a centralized trading desk that aggregates order flows within a financial institution. The desk can warehouse in-flow orders, ideally netting them against subsequent opposite orders (internalization), or route them to the market (externalization) and incur costs related to price impact and bid-ask spread. We model and solve this problem for a general class of in-flow processes, enabling us to study in detail how in-flow characteristics affect optimal strategy and core trading metrics. Our model allows for an analytic solution in semi-closed form and is readily implementable numerically. Compared with a standard execution problem where the order size is known upfront, the unwind strategy exhibits an additive adjustment for projected future in-flows. Its sign depends on the autocorrelation of orders; only truth-telling (martingale) flow is unwound myopically. In addition to analytic results, we present extensive simulations for different use cases and regimes, and introduce new metrics of practical interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)