Authors

Summary

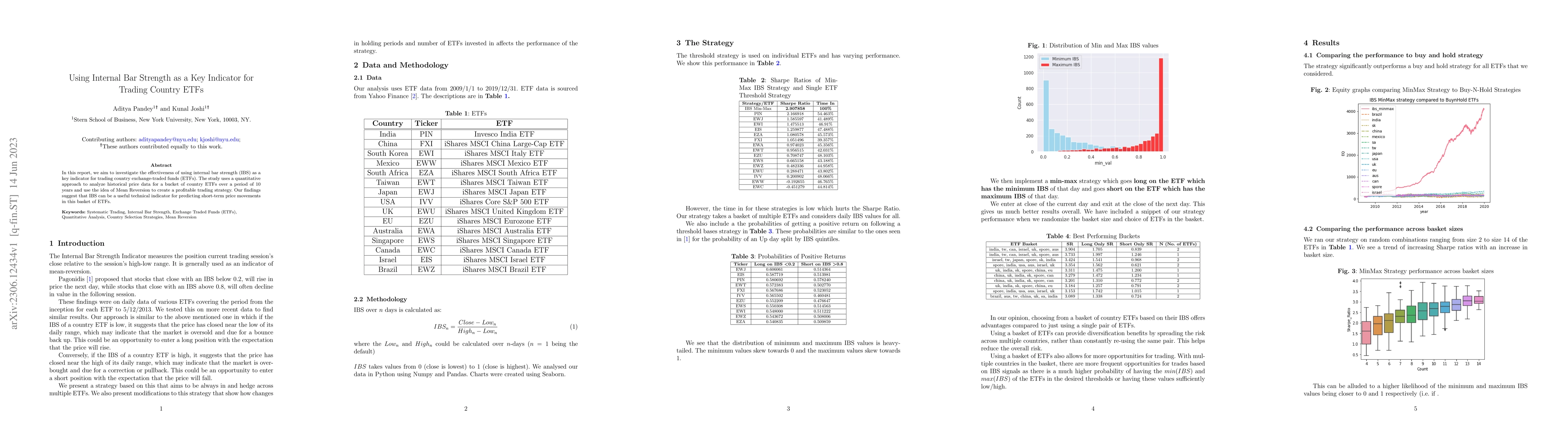

This report aims to investigate the effectiveness of using internal bar strength (IBS) as a key indicator for trading country exchange-traded funds (ETFs). The study uses a quantitative approach to analyze historical price data for a bucket of country ETFs over a period of 10 years and uses the idea of Mean Reversion to create a profitable trading strategy. Our findings suggest that IBS can be a useful technical indicator for predicting short-term price movements in this basket of ETFs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Technical Indicator-based Trading Strategies Using NSGA-II

Vadlamani Ravi, P. Shanmukh Kali Prasad, Vadlamani Madhav et al.

No citations found for this paper.

Comments (0)