Summary

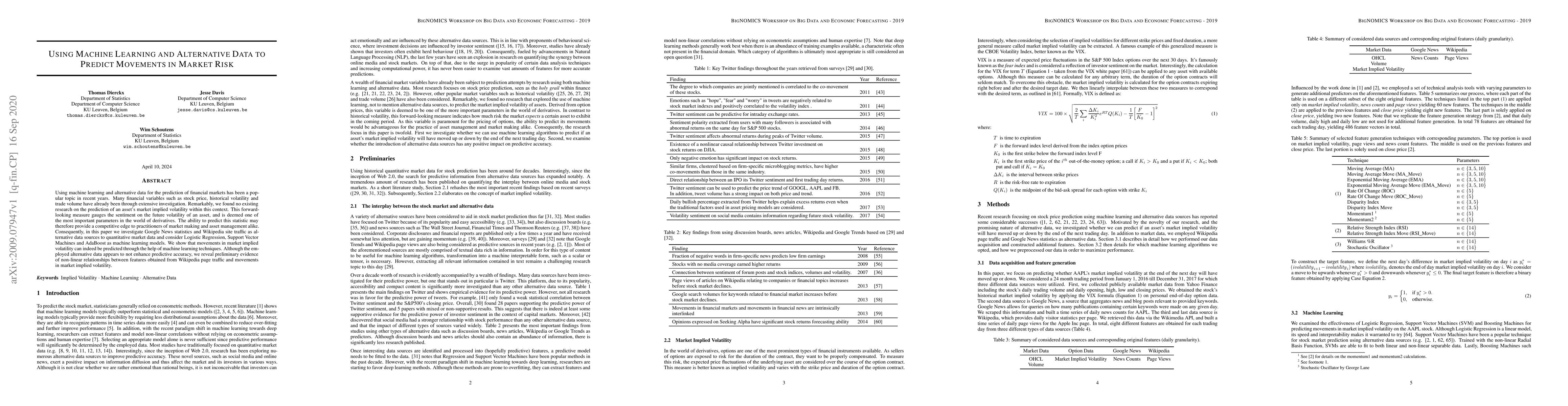

Using machine learning and alternative data for the prediction of financial markets has been a popular topic in recent years. Many financial variables such as stock price, historical volatility and trade volume have already been through extensive investigation. Remarkably, we found no existing research on the prediction of an asset's market implied volatility within this context. This forward-looking measure gauges the sentiment on the future volatility of an asset, and is deemed one of the most important parameters in the world of derivatives. The ability to predict this statistic may therefore provide a competitive edge to practitioners of market making and asset management alike. Consequently, in this paper we investigate Google News statistics and Wikipedia site traffic as alternative data sources to quantitative market data and consider Logistic Regression, Support Vector Machines and AdaBoost as machine learning models. We show that movements in market implied volatility can indeed be predicted through the help of machine learning techniques. Although the employed alternative data appears to not enhance predictive accuracy, we reveal preliminary evidence of non-linear relationships between features obtained from Wikipedia page traffic and movements in market implied volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCombining supervised and unsupervised learning methods to predict financial market movements

Gabriel Rodrigues Palma, Mariusz Skoczeń, Phil Maguire

Using Sentiment and Technical Analysis to Predict Bitcoin with Machine Learning

Arthur Emanuel de Oliveira Carosia

| Title | Authors | Year | Actions |

|---|

Comments (0)