Authors

Summary

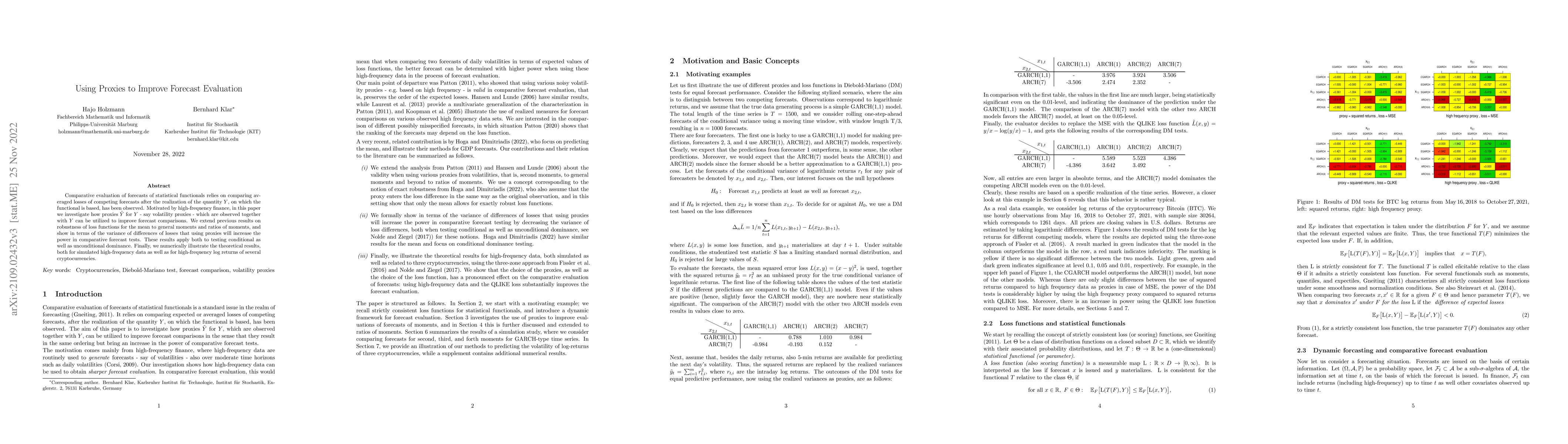

Comparative evaluation of forecasts of statistical functionals relies on comparing averaged losses of competing forecasts after the realization of the quantity $Y$, on which the functional is based, has been observed. Motivated by high-frequency finance, in this paper we investigate how proxies $\tilde Y$ for $Y$ - say volatility proxies - which are observed together with $Y$ can be utilized to improve forecast comparisons. We extend previous results on robustness of loss functions for the mean to general moments and ratios of moments, and show in terms of the variance of differences of losses that using proxies will increase the power in comparative forecast tests. These results apply both to testing conditional as well as unconditional dominance. Finally, we numerically illustrate the theoretical results, both for simulated high-frequency data as well as for high-frequency log returns of several cryptocurrencies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers3D Pose Nowcasting: Forecast the Future to Improve the Present

Alessandro Simoni, Lorenzo Seidenari, Alberto Del Bimbo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)