Summary

In this paper we study a utility maximization problem with random horizon and reduce it to the analysis of a specific BSDE, which we call BSDE with singular coefficients, when the support of the default time is assumed to be bounded. We prove existence and uniqueness of the solution for the equation under interest. Our results are illustrated by numerical simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

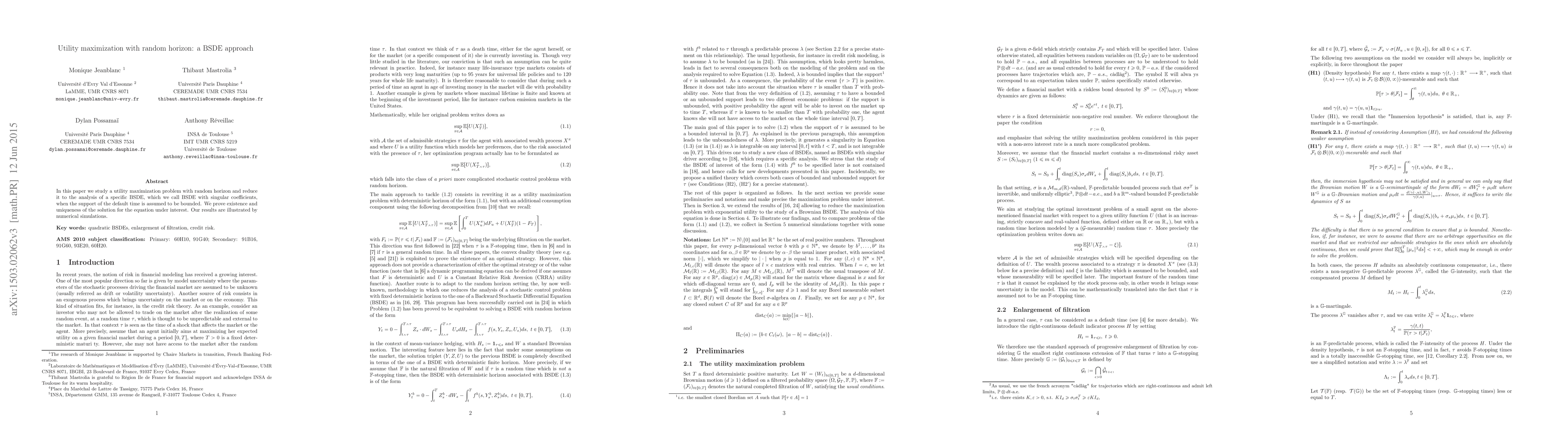

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)