Summary

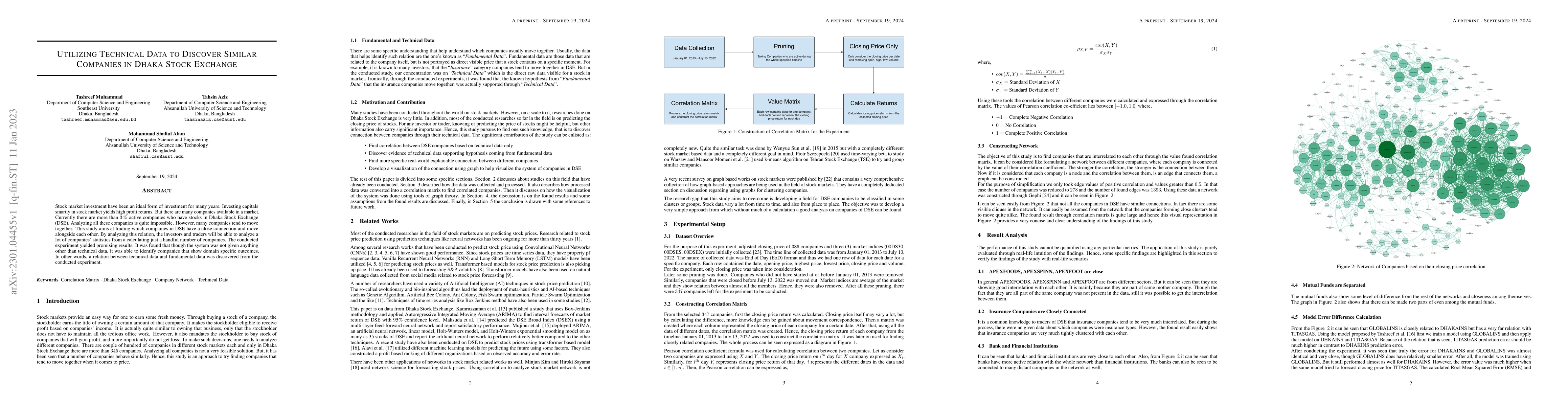

Stock market investment have been an ideal form of investment for many years. Investing capitals smartly in stock market yields high profit returns. But there are many companies available in a market. Currently there are more than $345$ active companies who have stocks in Dhaka Stock Exchange (DSE). Analyzing all these companies is quite impossible. However, many companies tend to move together. This study aims at finding which companies in DSE have a close connection and move alongside each other. By analyzing this relation, the investors and traders will be able to analyze a lot of companies' statistics from a calculating just a handful number of companies. The conducted experiment yielded promising results. It was found that though the system was not given anything other than technical data, it was able to identify companies that show domain specific outcomes. In other words, a relation between technical data and fundamental data was discovered from the conducted experiment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Study on Impact of Environmental Accounting on Profitability of Companies listed in Bombay Stock Exchange

Sudharani R, Suresh N, Nandini E. S

A Study on the Impact of Human Resource Accounting on Firms Value with Respect to Companies Listed in National Stock Exchange

Sudharani R, Suresh N, Anil S

Macroeconomic factors and Stock exchange return: A Statistical Analysis

Md. Fazlul Huq Khan, Md. Masum Billah

No citations found for this paper.

Comments (0)