Authors

Summary

Machine learning methods are getting more and more important in the development of internal models using scenario generation. As internal models under Solvency 2 have to be validated, an important question is in which aspects the validation of these data-driven models differs from a classical theory-based model. On the specific example of market risk, we discuss the necessity of two additional validation tasks: one to check the dependencies between the risk factors used and one to detect the unwanted memorizing effect. The first one is necessary because in this new method, the dependencies are not derived from a financial-mathematical theory. The latter one arises when the machine learning model only repeats empirical data instead of generating new scenarios. These measures are then applied for an machine learning based economic scenario generator. It is shown that those measures lead to reasonable results in this context and are able to be used for validation as well as for model optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

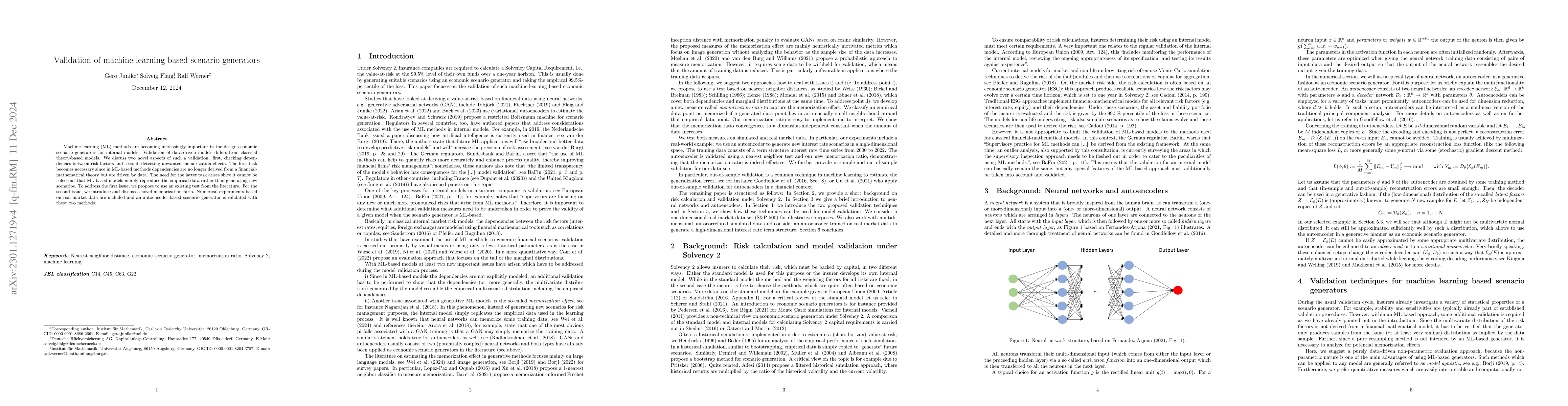

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparing Cluster-Based Cross-Validation Strategies for Machine Learning Model Evaluation

Mariana Recamonde-Mendoza, Afonso Martini Spezia

No citations found for this paper.

Comments (0)