Summary

In this paper, the TF system of two-coupled Black-Scholes equations for pricing the convertible bonds is solved numerically by using the P1 and P2 finite elements with the inequality constraints approximated by the penalty method. The corresponding finite element ODE system is numerically solved by using a modified Crank-Nicolson scheme, in which the non-linear system is solved at each time step by the Newton-Raphson method for non-smooth functions. Moreover, the corresponding Greeks are also calculated by taking advantage of the P1-P2 finite element approximation functions. Numerical solutions by the finite element method compare favorably with the solutions by the finite difference method in literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

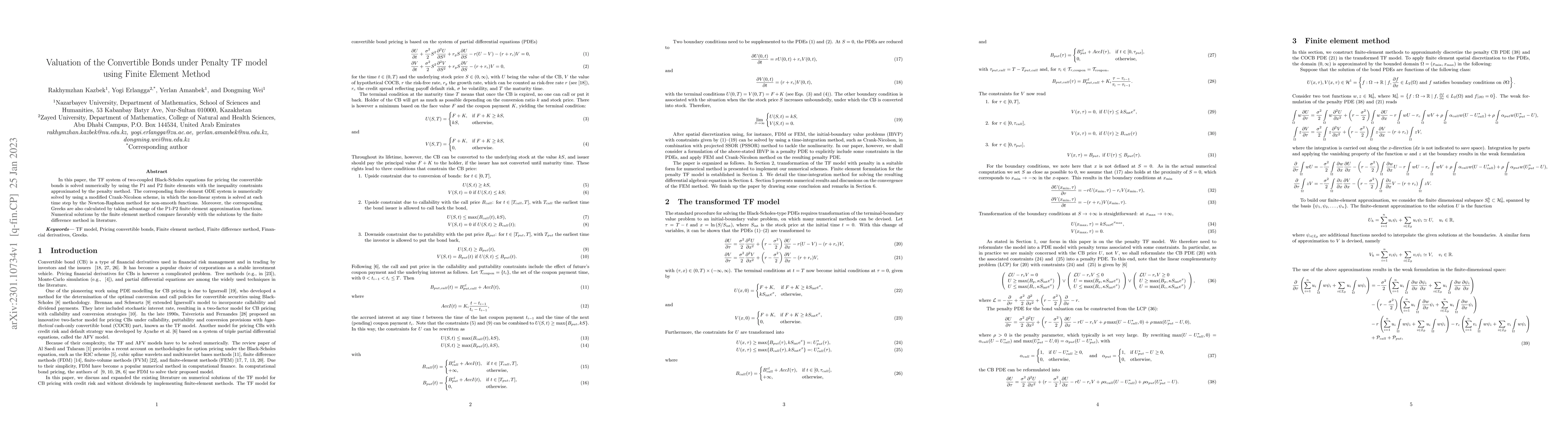

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)