Authors

Summary

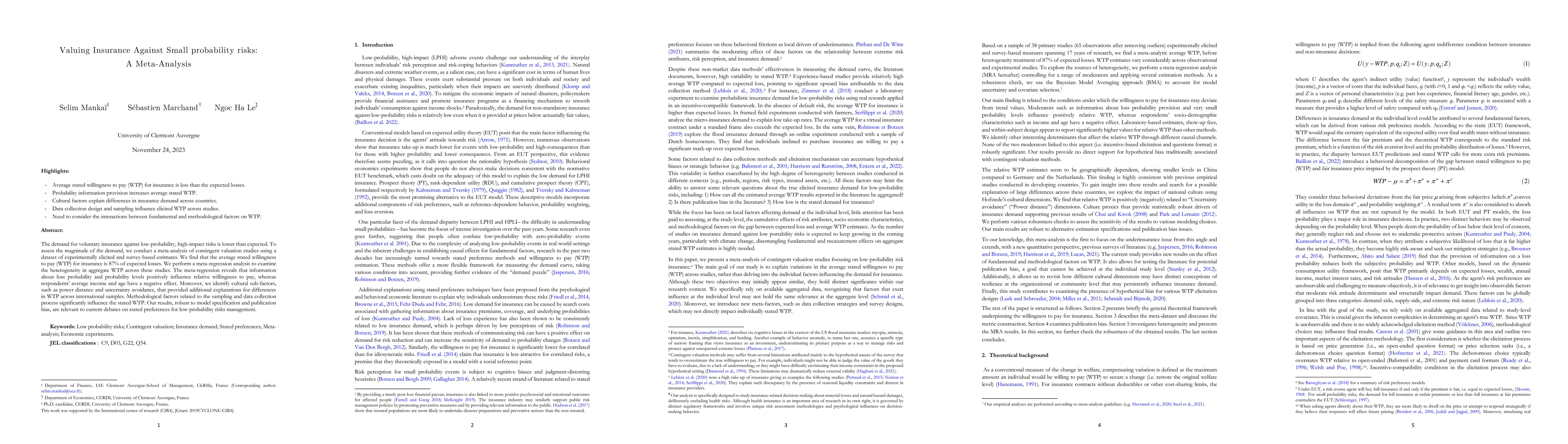

The demand for voluntary insurance against low-probability, high-impact risks is lower than expected. To assess the magnitude of the demand, we conduct a meta-analysis of contingent valuation studies using a dataset of experimentally elicited and survey-based estimates. We find that the average stated willingness to pay (WTP) for insurance is 87% of expected losses. We perform a meta-regression analysis to examine the heterogeneity in aggregate WTP across these studies. The meta-regression reveals that information about loss probability and probability levels positively influence relative willingness to pay, whereas respondents' average income and age have a negative effect. Moreover, we identify cultural sub-factors, such as power distance and uncertainty avoidance, that provided additional explanations for differences in WTP across international samples. Methodological factors related to the sampling and data collection process significantly influence the stated WTP. Our results, robust to model specification and publication bias, are relevant to current debates on stated preferences for low-probability risks management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Mutual Insurance Model for Hedging Against Cyber Risks in Power Systems Deploying Smart Technologies

Wei Wei, Lingfeng Wang, Pikkin Lau et al.

A Framework for Digital Asset Risks with Insurance Applications

Zhengming Li, Jianxi Su, Maochao Xu et al.

No citations found for this paper.

Comments (0)