Authors

Summary

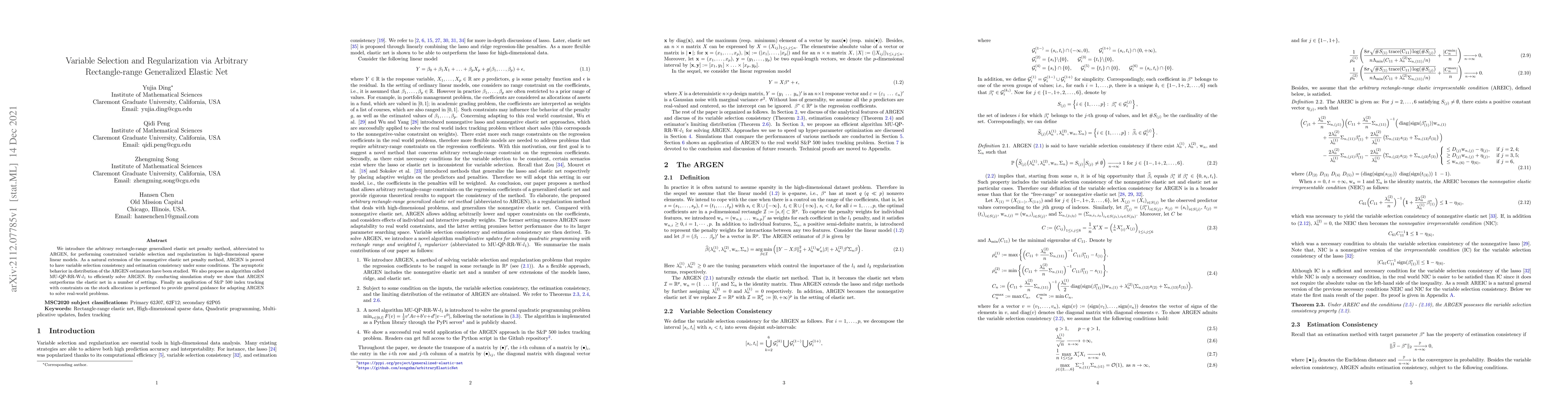

We introduce the arbitrary rectangle-range generalized elastic net penalty method, abbreviated to ARGEN, for performing constrained variable selection and regularization in high-dimensional sparse linear models. As a natural extension of the nonnegative elastic net penalty method, ARGEN is proved to have variable selection consistency and estimation consistency under some conditions. The asymptotic behavior in distribution of the ARGEN estimators have been studied. We also propose an algorithm called MU-QP-RR-W-$l_1$ to efficiently solve ARGEN. By conducting simulation study we show that ARGEN outperforms the elastic net in a number of settings. Finally an application of S&P 500 index tracking with constraints on the stock allocations is performed to provide general guidance for adapting ARGEN to solve real-world problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)