Summary

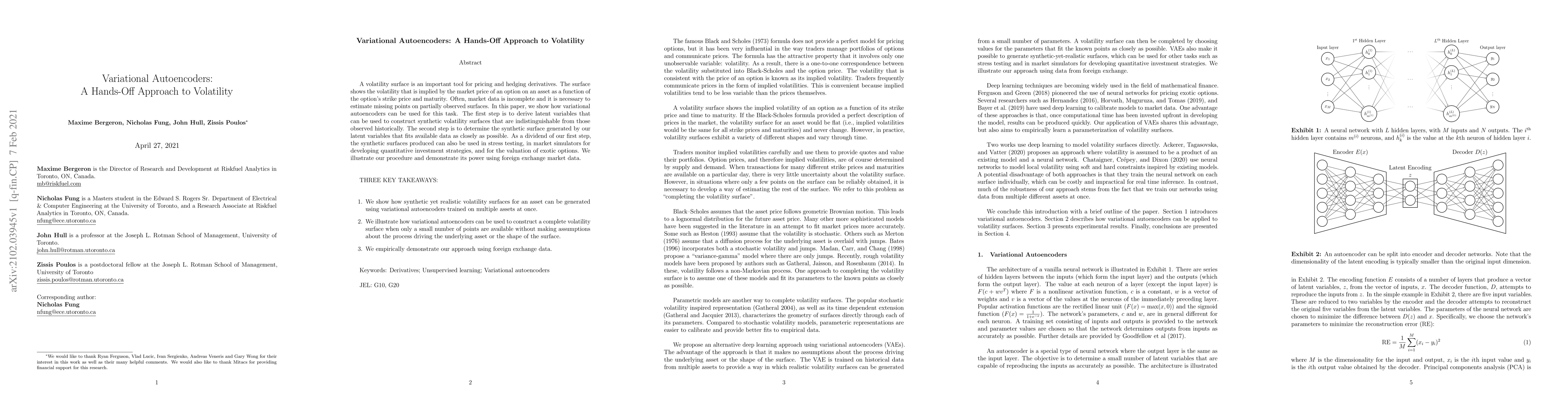

A volatility surface is an important tool for pricing and hedging derivatives. The surface shows the volatility that is implied by the market price of an option on an asset as a function of the option's strike price and maturity. Often, market data is incomplete and it is necessary to estimate missing points on partially observed surfaces. In this paper, we show how variational autoencoders can be used for this task. The first step is to derive latent variables that can be used to construct synthetic volatility surfaces that are indistinguishable from those observed historically. The second step is to determine the synthetic surface generated by our latent variables that fits available data as closely as possible. As a dividend of our first step, the synthetic surfaces produced can also be used in stress testing, in market simulators for developing quantitative investment strategies, and for the valuation of exotic options. We illustrate our procedure and demonstrate its power using foreign exchange market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterpolation of Missing Swaption Volatility Data using Gibbs Sampling on Variational Autoencoders

Ivo Richert, Robert Buch

Arbitrage-Free Implied Volatility Surface Generation with Variational Autoencoders

Sebastian Jaimungal, Maxime Bergeron, Xiaorong Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)