Summary

Some online advertising offers pay only when an ad elicits a response. Randomness and uncertainty about response rates make showing those ads a risky investment for online publishers. Like financial investors, publishers can use portfolio allocation over multiple advertising offers to pursue revenue while controlling risk. Allocations over multiple offers do not have a distinct winner and runner-up, so the usual second-price mechanism does not apply. This paper develops a pricing mechanism for portfolio allocations. The mechanism is efficient, truthful, and rewards offers that reduce risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

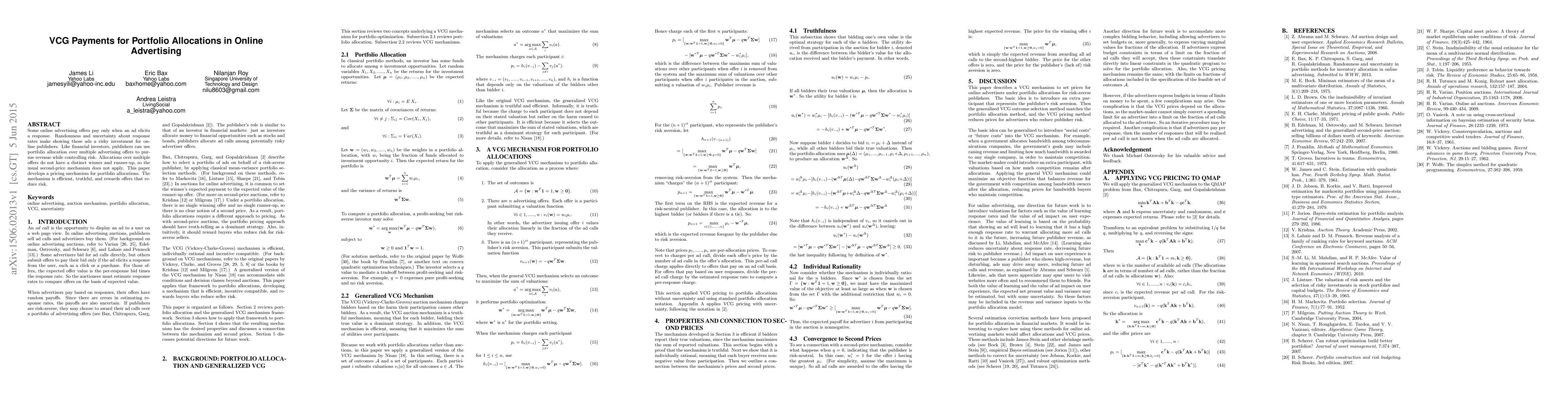

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-channel Budget Coordination for Online Advertising System

Wei Ning, Dehong Gao, Libin Yang et al.

Eliciting Truthful Feedback for Preference-Based Learning via the VCG Mechanism

Maryam Kamgarpour, Andreas Schlaginhaufen, Anna Maddux et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)